The SBA 8(a) Business Development Program seeks to help socially and economically disadvantaged small business owners by offering training and technical assistance.

Our content reflects the editorial opinions of our experts. While our site makes money through

referral partnerships, we only partner with companies that meet our standards for quality, as outlined in our independent

rating and scoring system.

Are you a small disadvantaged business in search of government contracts? The SBA 8(a) program might be right for you.

In this article, we’ll define the “socially and economically disadvantaged individuals” requirement for SBA 8(a) federal certification, as well as provide other SBA 8 (a) application and eligibility information. Plus, you will learn about the benefits of the SBA 8(a) business development program and government contracting program.

Read on to find out more.

What Is The SBA 8(a) Program?

The SBA 8(a) program is a nine-year program to help small socially and economically disadvantaged businesses qualify for federal contracts and other assistance. SBA 8(a)-certified small businesses will receive government contracting preferences in addition to technical assistance and training.

SBA 8(a) Business Development Program Overview

The SBA 8(a) program is for a very specific type of business. To be a good candidate for the SBA 8(a) program, you must operate a minority-owned business that manufactures or sells something the federal government buys. This is a program for businesses looking to qualify for federal contracts.

Additionally, your business must be classified as small (in accordance with your primary North American Industry Classification System (NAICS) code), and the owner(s) must have limited financial means in terms of their net worth, income, and total assets. If you meet all these qualifications and become certified, your business will receive training to become more competitive and could be awarded federal contracts.

Keep in mind that the program is pretty exclusive, and even if your business is SBA 8(a) certified, this doesn’t guarantee you will win any federal contracts. Per the SBA Certify website, only 610 businesses were approved for the 8(a) Program in 2021, and there were only 4,910 active 8(a) Program participants at the end of 2021. Still, it’s a good idea for eligible businesses to get SBA 8(a) certified, as the program comes with certain benefits.

8(a) Program Benefits For Eligible Small Businesses

The main benefit of the SBA 8(a) program is it increases your likelihood of winning federal contracts. However, there are other benefits to 8(a) certification, too. Even if your firm isn’t ready to contract with the federal government, the SBA 8(a) program can help you get there.

- Access To Competitive Contracts: The federal government has a goal of awarding at least 5% of federal contracts to small disadvantaged businesses every year, and 8(a) certification is how you officially designate your business as being part of this eligible 5%. Through the program, you may be able to access both sole-source and competitive set-aside contracts.

- Business Development Assistance: This includes one-on-one assistance from Business Opportunity Specialists to help you grow and achieve your business objectives over your nine-year term.

- Connect With Experts: Through SBA 8(a), you can connect with experts in the areas of federal procurement and compliance who can assist with meeting government contracting regulations.

- Connect With Established Businesses: With SBA 8(a) certification, you can receive mentorship from experienced firms through the SBA Mentor-Protégé program. You can even pursue a joint venture with a mentor so you can increase your capacity and compete together for government contracts.

- Qualify For Federal Surplus Property: Through the SBA 8(a) program, you can qualify to receive federal surplus property on a priority basis.

- Free Training: Your business will also receive free training from SBA’s 7(j) Management and Technical Assistance program.

Does Your Small Business Qualify For SBA 8(a) Certification?

To qualify for SBA 8(a) certification, your business must be at least 51% owned and controlled by socially and economically disadvantaged individuals.

You must also meet certain other criteria, including:

- You operate a small business in the United States

- You are a US citizen.

- Your company manufactures or produces something that the federal government purchases–for example, IT solutions or mechanical engineering services with military applications.

- Your business has a good track record and has been in operation for at least two years.

- Your business is generating revenue.

- You can demonstrate good character and the ability to perform well on contracts.

Don’t meet all the qualifications for 8(a)? You might still qualify for an SBA loan.

Check out our complete guide to SBA loans, where we explain everything you need to know.

Who Are Socially & Economically Disadvantaged Individuals?

Socially and economically disadvantaged individuals are non-White small business owners who also have limited financial resources. Specifically, here’s what that means:

- Socially Disadvantaged Individuals are small business owners who are Black American, Native American, Hispanic American, Asian Pacific American, or Subcontinent Asian American.

- Alternatively, the business is owned by an Alaska Native corporation, Community Development Corporation, Indian tribe, or Native Hawaiian organization.

- Alternatively, the business owner can prove they are socially disadvantaged in another way, such as having a physical handicap.

- Economically Disadvantaged Individuals are small business owners who have a personal net worth of $850,000 or less, adjusted gross income of $400,000 or less, and assets totaling $6.5 million or less.

What Does It Mean To Be 8(a) Certified?

What is 8(a) certification? Being 8(a) certified means that your business is now part of the SBA 8(a) program and is eligible to start receiving the benefits that the program provides. Your term will last nine years. Once certified, your profile in the System for Award Management (SAM)—the official government website for contract opportunities—will display your approval date and exit date for the 8(a) program.

Maintaining 8(a) Eligibility & Certification

After your business becomes 8(a) certified, you will need to maintain your certification by verifying your eligibility once a year. This means that there will be an annual review each year, during which you will submit the requested information to your servicing SBA District Office. The SBA will use this information to verify that your business meets statutory and regulatory requirements.

How To Apply For The SBA 8(a) Program

Applying for SBA 8(a) certification is a multi-step process and requires you to submit various documents along with your application. This section will go over the main steps to complete an SBA 8(a) application. You can also find this information and more at the 8(a) application website (certify.SBA.gov).

Step 1. Determine Your Eligibility

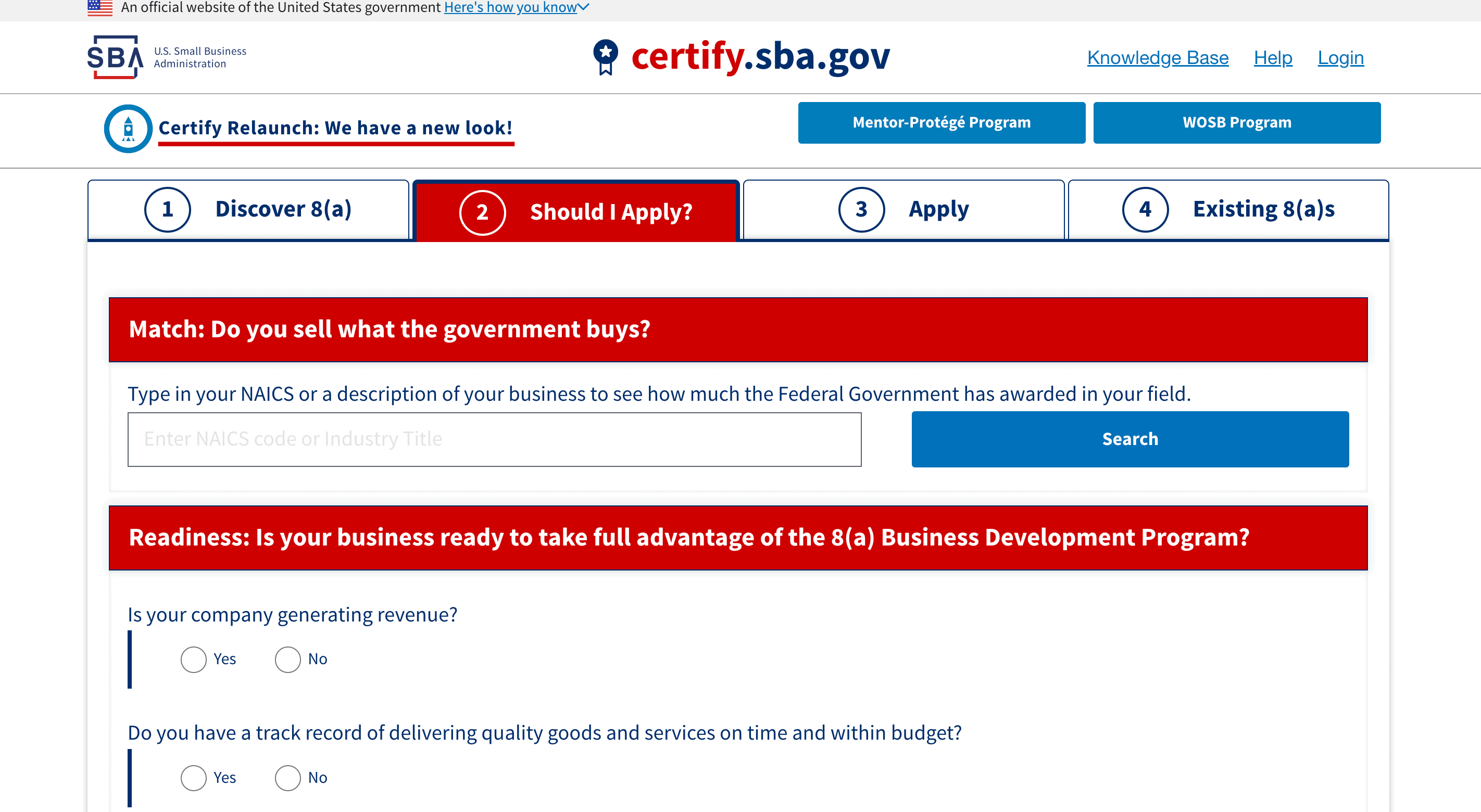

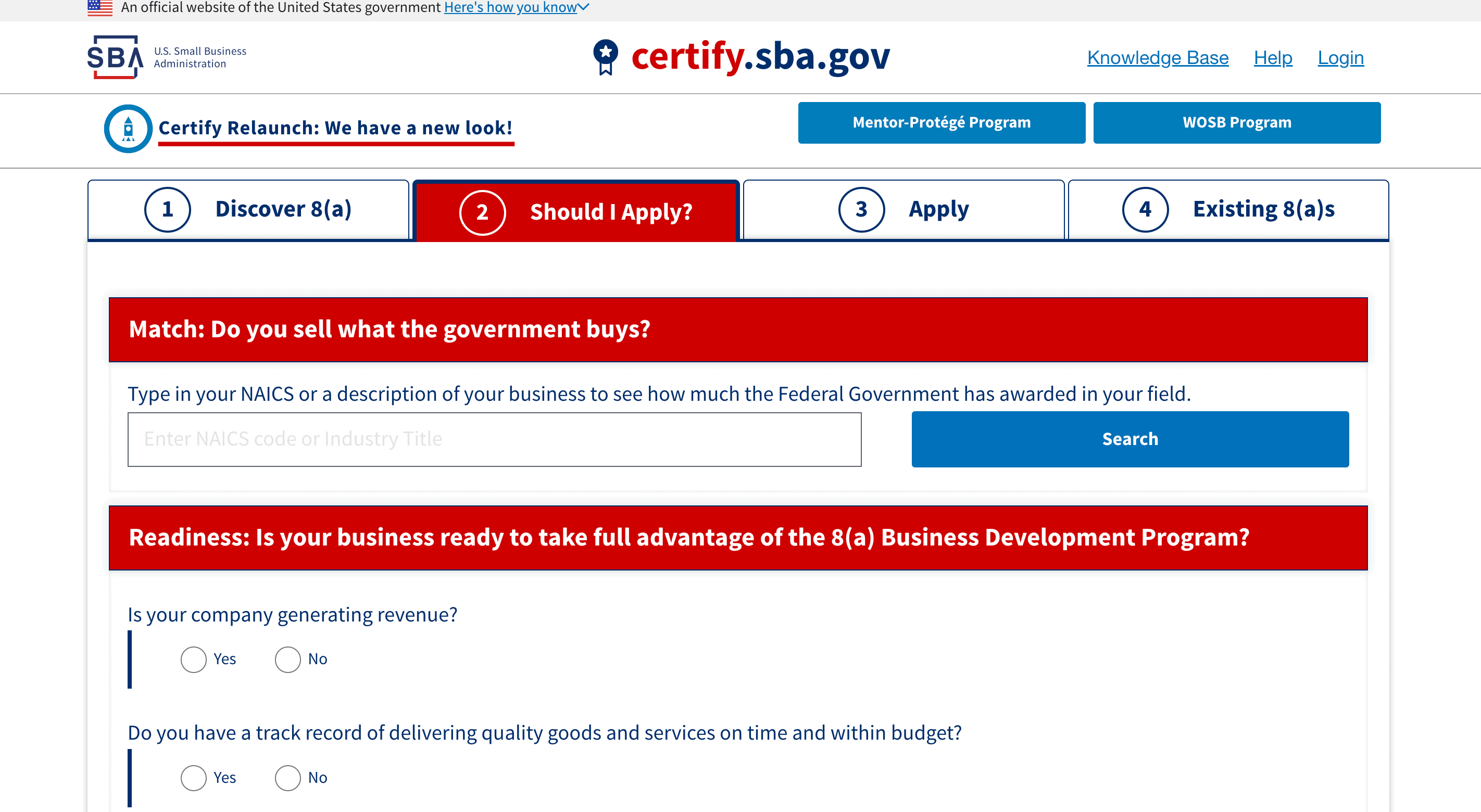

First, you need to make sure your business is eligible for the SBA 8(a) program. The SBA has a tool to help you determine this. Go to the SBA Certify website and fill out the Should I Apply? tool (see screenshot below). The tool will ask you for your NAICS number, so be sure to have that handy.

Step 2. Gather Documents

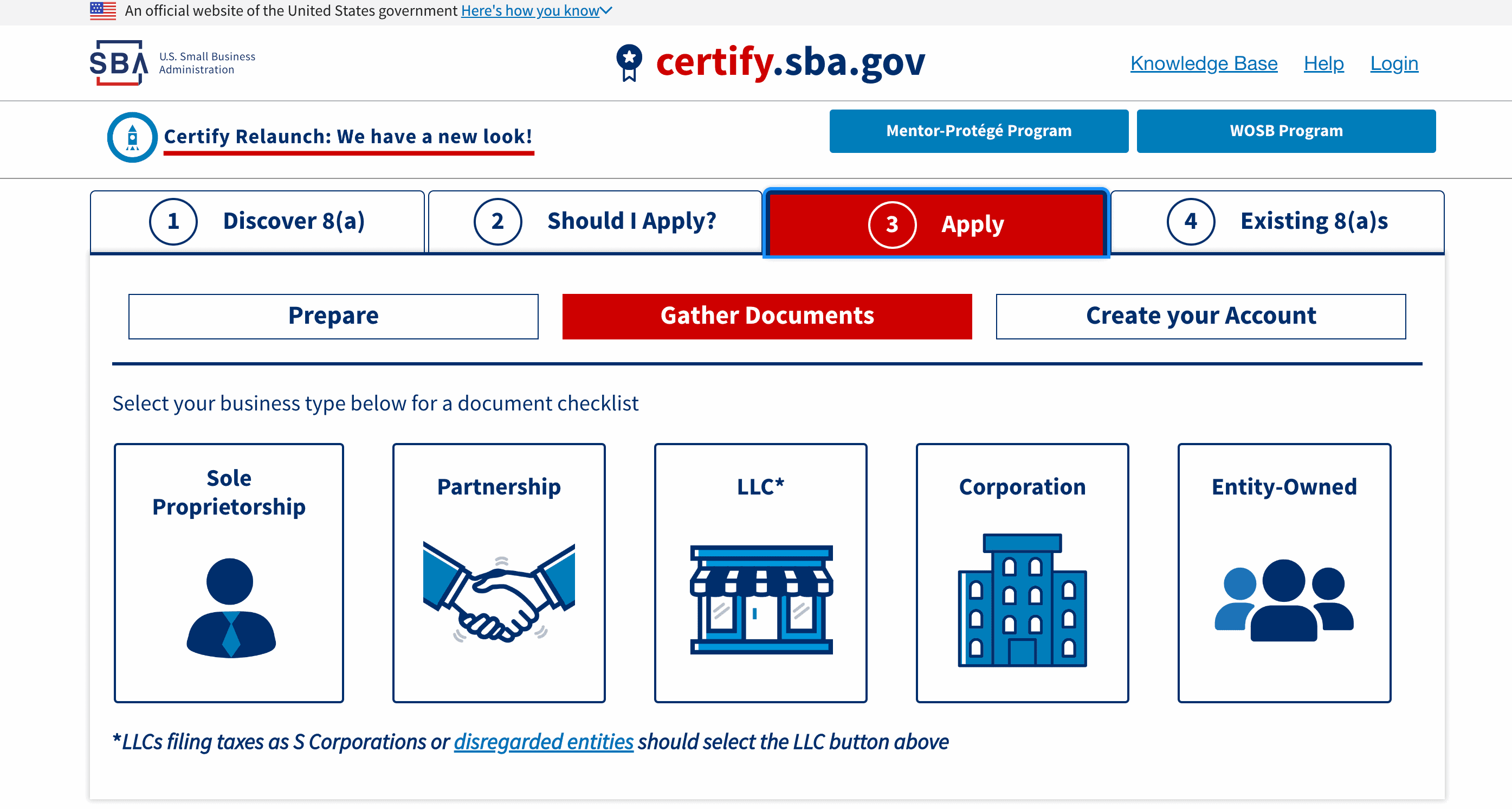

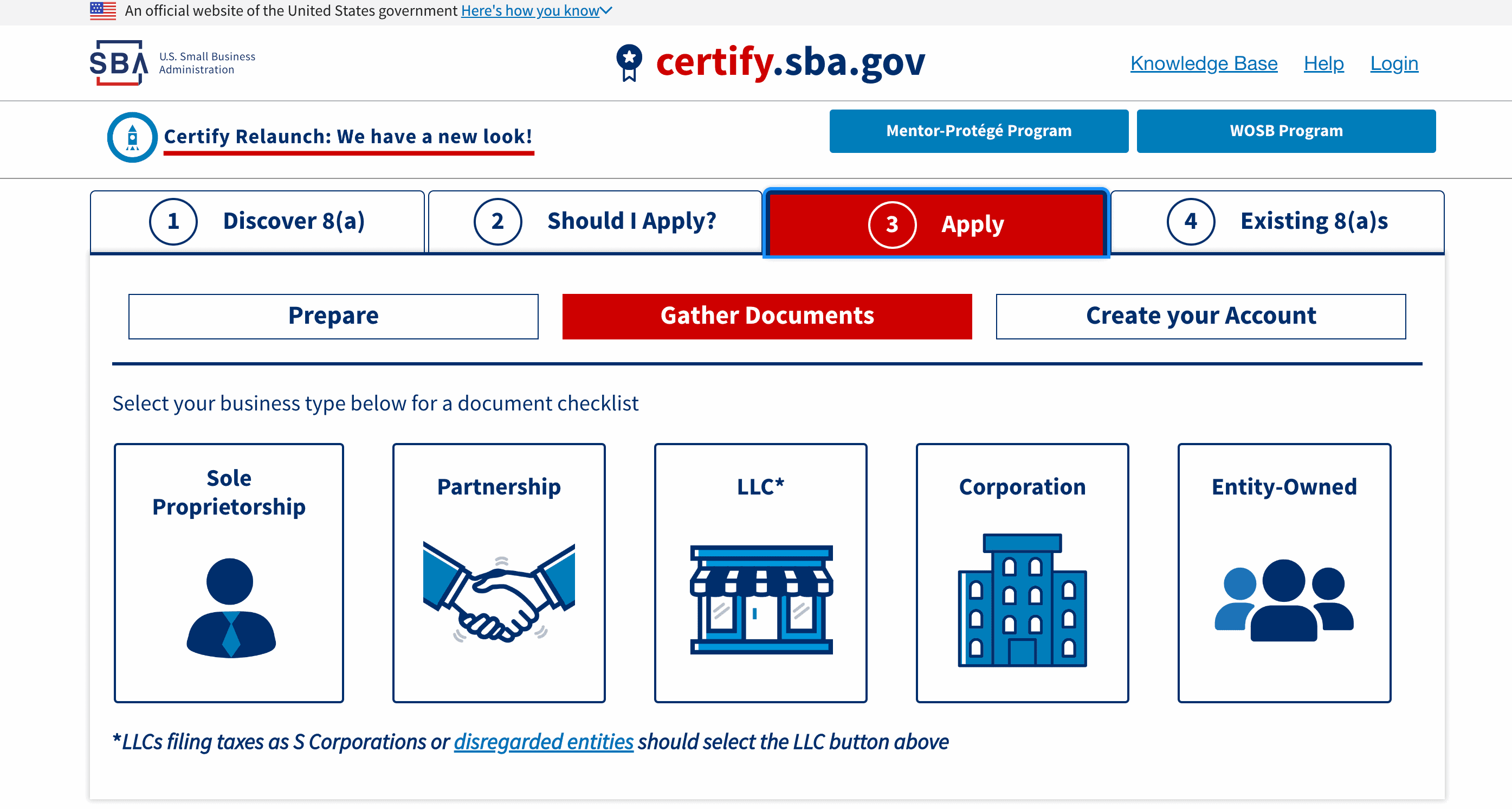

The documents you’ll need to apply for SBA 8(a) certification depend on your business structure. You can download the appropriate document checklist from the SBA Certify website, as pictured below:

Step 3. Register With SAM.gov

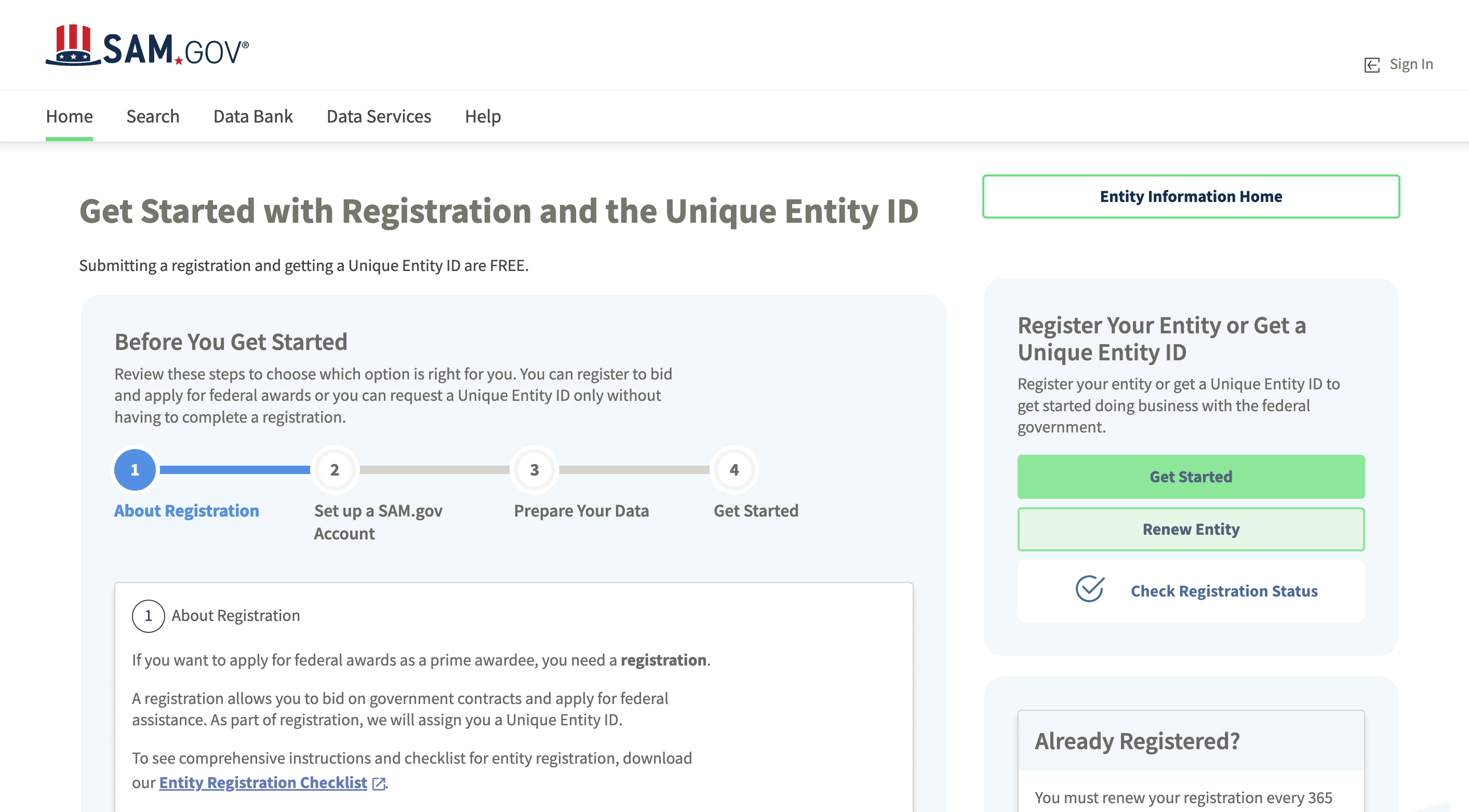

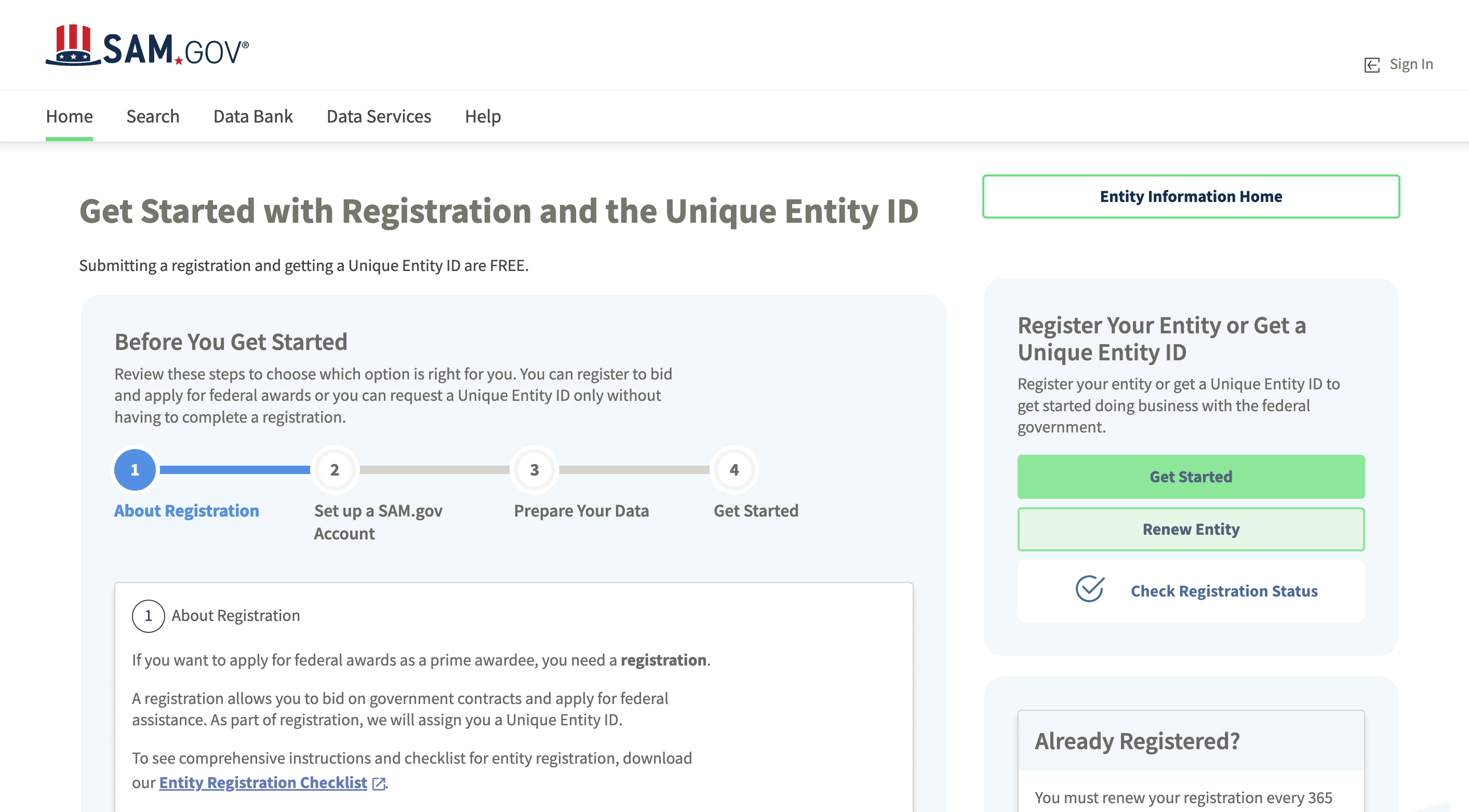

Before you can submit an 8(a) application, your business needs to be registered in the System for Award Management (SAM) (see screenshot below). Upon registration, you’ll receive a Unique Entity ID (UEI), which will be located on your entity registration record.

After you submit your information, SAM will need to approve you before you can apply for 8(a). The approval process can take up to 72 hours.

Step 4. Create SBA Certify Account To Access SBA 8(a) Application

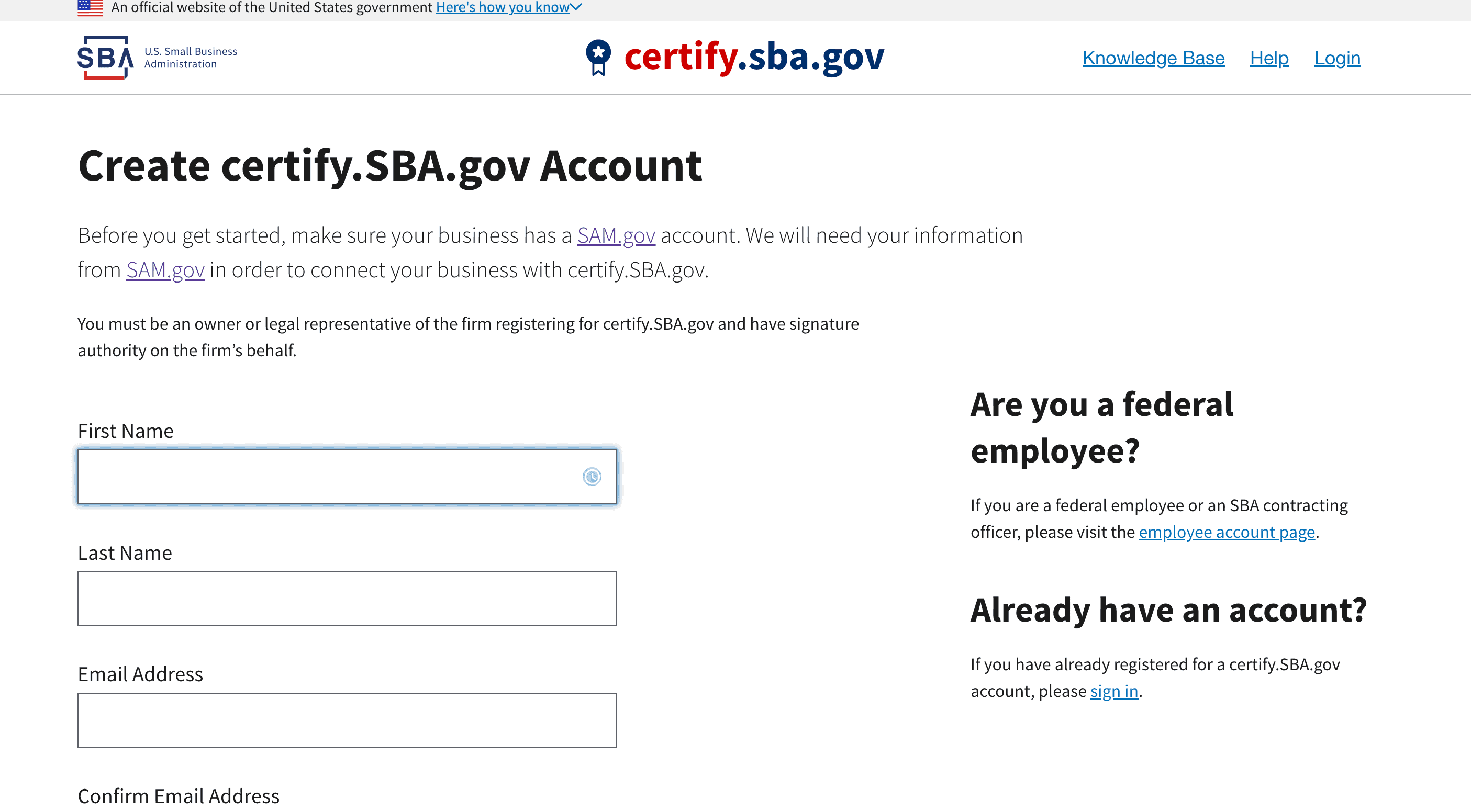

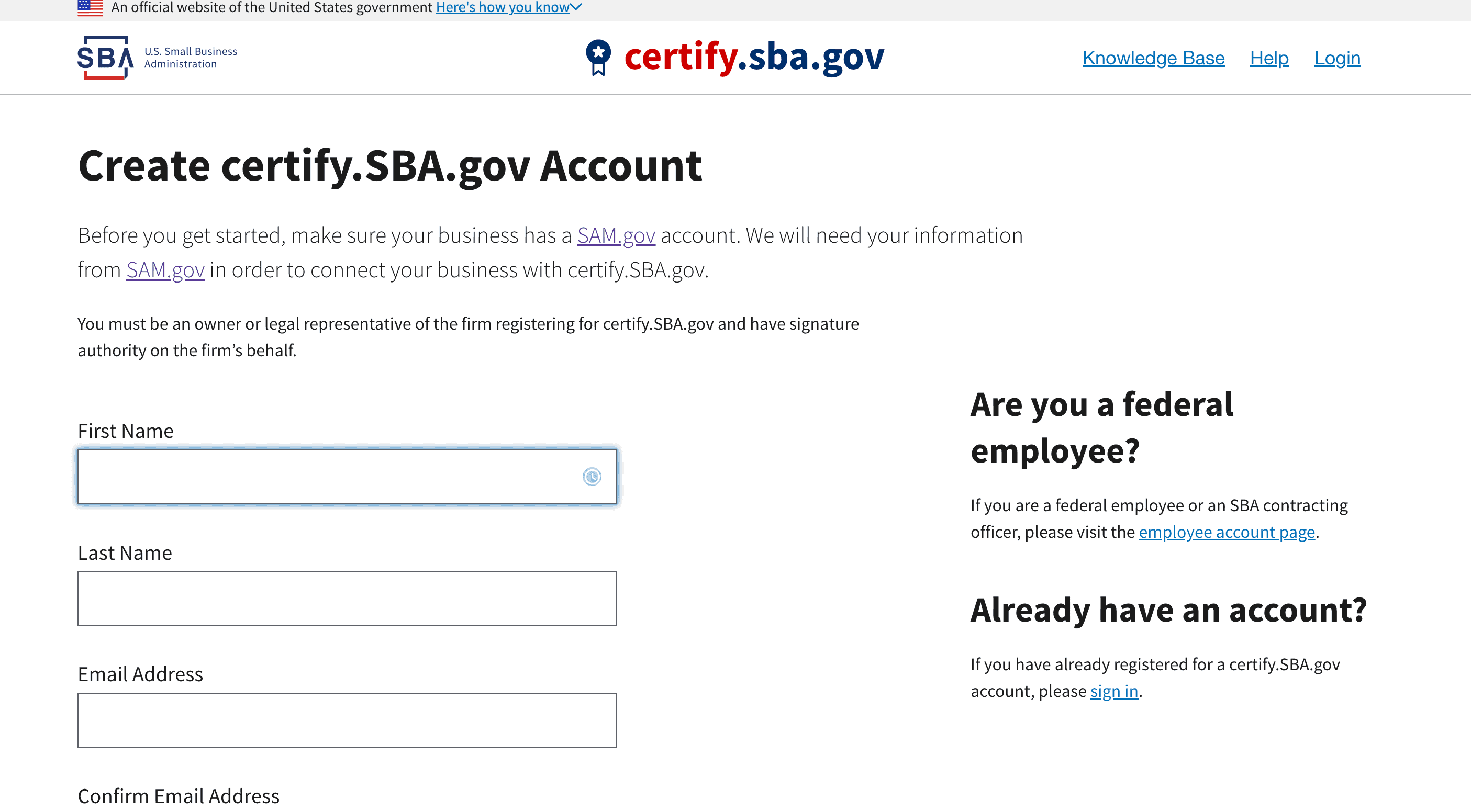

Once you complete steps 1-3, you can apply for SBA 8(a) certification on the SBA Certify website. To access the SBA 8(a) application, you’ll first need to create a certify.SBA.gov account on SBA Certify (see screenshot below).

Note that to create your Certify account and start your application, you will need to provide your UEI, MPIN, and the TIN to link your SAM.gov profile. Again, you can find additional SBA 8(a) application tips and guides on the SBA Certify website.

Once the SBA has determined your application is complete, they have 90 days to process your SBA 8(a) application and deliver a decision.

Is The SBA 8(a) Program A Good Match For Your Small Business?

The SBA 8(a) program is a good match for certain small businesses: small, minority-owned businesses in search of government contracting jobs. You will likely need to submit a lot of documentation regarding your financials, and the total process can take several months. Ultimately, few businesses are approved for this program—and even if you are certified as 8(a), this still doesn’t guarantee you will earn federal contracts.

If your business doesn’t meet SBA 8(a) eligibility requirements or you need additional help to grow your business, a small business loan or SBA loan might be a better solution. Take a look at the top small business loans and the best SBA lenders to find financing options for all types of small businesses.