Tired of slow-paying customers? Learn how to get your invoices paid faster with 10 tried and true industry tips.

Late invoices seem like an inevitable part of running a business, but they don’t have to be. That’s why we’ve created a list of practical steps you can take to increase your chances of getting paid on time.

Here are our top ten tips to get your invoices paid faster.

10 Tips To Get Your Invoices Paid Faster

Encourage on-time payments with these top ten tips to get invoices paid faster, including knowing how to word invoices, when to send invoice reminders, what payment options to offer, and more.

Tip 1: Save Time & Money With Online Invoicing

Online invoicing is easier and more cost-effective than printing invoices, stuffing envelopes, and waiting on the mailman. Best of all, you can send them instantly, speeding up the timeline of when you get paid by your customers.

While you may need to spend a small monthly fee on invoicing or accounting software, you’ll also save money on envelopes, ink, paper, and postage once you switch to online invoicing.

In addition to ease, speed, and cost, online invoicing makes it easy to avoid delays like lost mail or invoices that are sent to the wrong address. Most invoice software offers invoice tracking, so you’ll know when your customers receive and view their invoices.

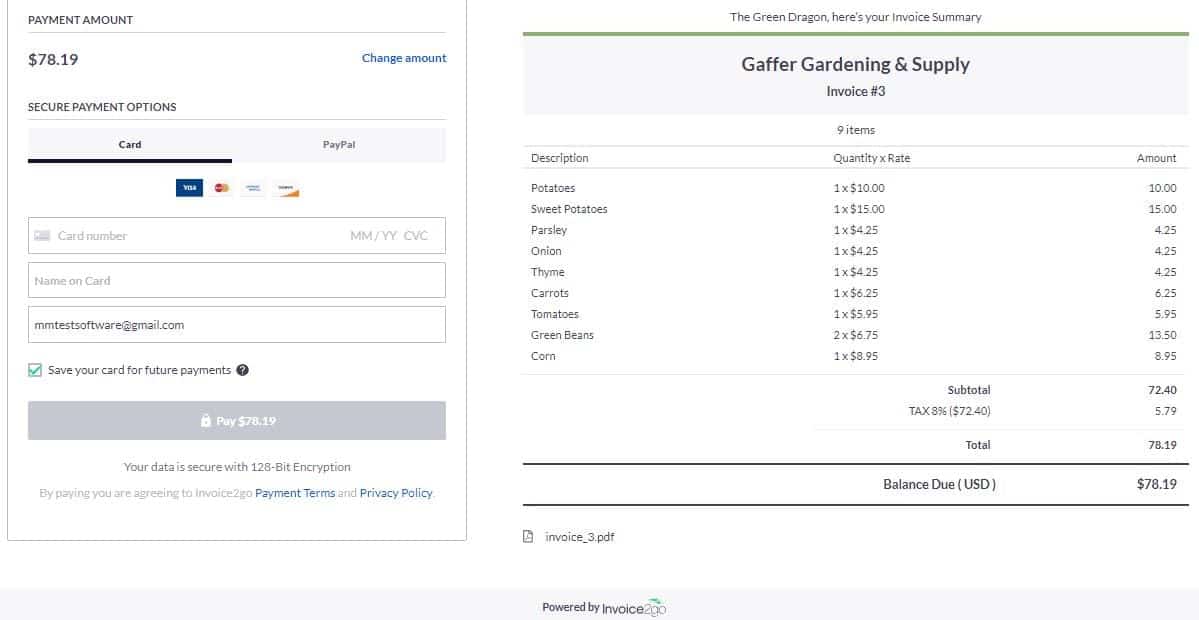

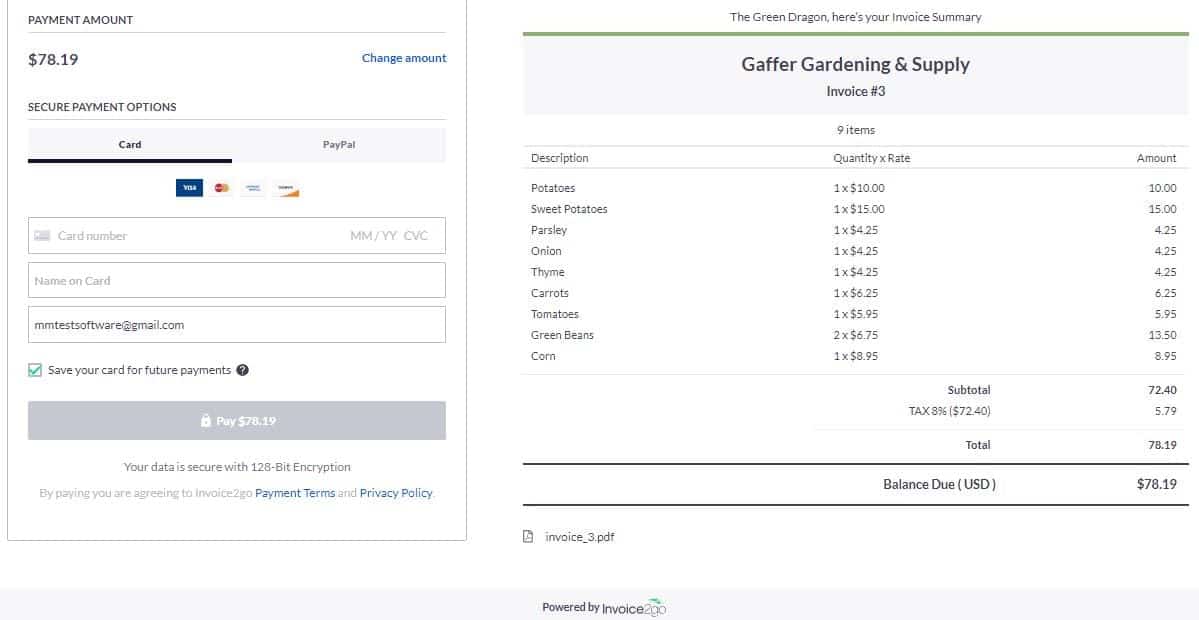

Tip 2: Accept Invoice Payments Online

When it comes to getting invoices paid fast, the key is to make it as easy as possible for customers to pay you. Payment processors make invoice payments quick and convenient for you and your customers. Most invoicing and accounting programs offer multiple payment processing options.

To learn more about accepting online payments, download our free Beginner’s Guide to Payment Processing.

Tip 3: Choose An Effective Invoice Template

Choosing the right invoice template can play a role in getting your invoices paid on time. Fortunately, most invoicing software programs offer multiple template options.

Pick a template that is attractive, simple, and easy to read. This includes choosing a legible font like Arial or Helvetica. Avoid serif fonts that are harder to read and make invoices look outdated and cluttered

Make sure that your invoices include the following:

- Due date

- Invoice amount

- Your company’s contact and payment information

- Products or services the customer is paying for

- Terms and conditions

Clarifying and highlighting this information makes it easier for your customers to know when and how to pay you, which can speed up the payment process.

Here are a few examples of strong, attractive invoice templates:

Tip 4: Choose The Right Invoice Due Date

To get paid in a timely manner, choose the right due date for your invoices.

Invoices that are marked “due upon receipt” don’t give a clear date for payment, leading to potential late payments. Net 30 due dates (payment due 30 days after the invoice is sent) can also be confusing for customers.

Be clear and specific about your due dates. When customers have a set-in-stone deadline, they are more likely to pay on time.

Maverick Tip: Instead of using terms like Net 30 or Net 60, add a specific due date to your invoice. If you prefer Net 30 terms and an invoice is sent on July 1, mark the due date as July 31.

You may also consider moving up your due date. For example, if you typically give 30 days to pay, consider changing your policy to 15 days.

Tip 5: Offer Invoice Discounts For On-Time & Early Payments

Get your invoices paid quickly by offering a discount to customers who pay early, i.e., a 5% or 10% off for customers who pay within 10 days. While you may lose a small amount of your sale, receiving early payment can help you avoid potential cash flow issues.

Tip 6: Enforce Late Fees On Overdue Invoices

If incentives don’t work, you can also consider charging a late fee or interest for late payments. If you opt to charge late fees, don’t forget to:

- Clearly state your late fee policy in your invoice’s terms and conditions

- Send reminders to customers that you will charge interest or fees if the payment is late

Tip 7: Send Invoices Promptly

The sooner you send your invoice, the sooner you can get paid. Plus, customers are more likely to pay quickly for items or services that they just received.

It’s easy to become overwhelmed and fall behind on invoices. Fortunately, invoicing apps and software can automate the process, allowing you to send recurring invoices, automatically schedule invoices in advance, or send invoices from your phone using a mobile app.

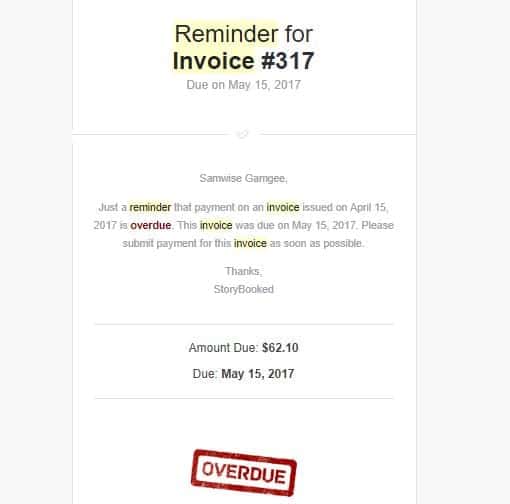

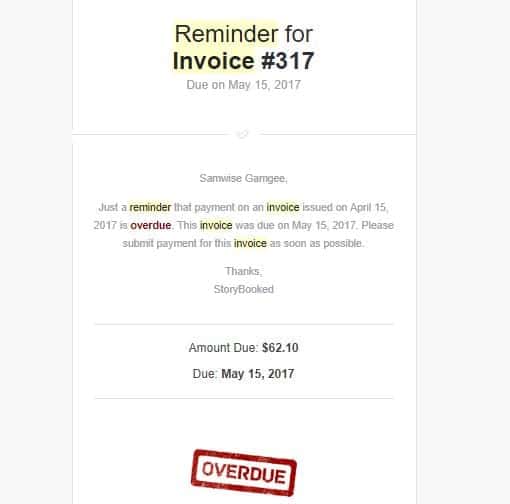

Tip 8: Send Invoice Payment Reminders

Another way to avoid late-paying customers is to send regular invoice payment reminders. Send an invoice reminder a few days before the invoice is due, the day the invoice is due, and a few days after the invoice is missed.

If the first reminder isn’t enough to motivate your customers to pay, continue sending email reminders and calling the customer on the phone. As a business owner, it is your responsibility to reach out to slow-paying customers.

Most invoicing software allows you to create automatic payment reminders. You may also have the option of running an accounts payable report to easily see outstanding balances.

Tip 9: Invoice Your Customers In Phases

If you run a project-based business, consider invoicing in phases. Instead of sending a single invoice at the end of the job, try invoicing after milestones of the tasks are complete.

You can also charge a deposit for your work to discourage customers from avoiding payment altogether.

Tip 10: Simplify Invoicing With Software

Here at Merchant Maverick, we recommend that small businesses use accounting or invoicing software to send online invoices, balance the books, and receive online payments.

In this post, we’ve already mentioned several perks of e-invoicing and invoicing software. But here’s a summary of what invoicing software can do for your business:

- Automate your invoicing process

- Send online invoices

- Accept invoice payments online

- See when customers have received & viewed invoices

- Send automated payment reminders

- Create default email messages to include with your invoices

- Create terms and conditions

- Run helpful reports

- Send invoices from your phone with mobile apps

- Save time and money

If you a ready to take advantage of these benefits and simplify your invoicing process, here are the best invoicing software options on the market.

What If My Customers Still Don’t Pay Their Invoices On Time?

If you’ve tried all of these tips and still aren’t getting paid, there are several things you can do. While you can take legal action, this method is often costly, time-consuming, and may alienate your customers.

If you’re suffering from inconsistent or poor cash flow due to slow-paying customers, invoicing financing might be the perfect solution for you.

With invoice financing, you can sell your unpaid invoices to a factoring company in exchange for immediate cash or you can use your invoices as collateral for a line of credit. This strategy can help resolve temporary cash flow issues until your outstanding invoices are paid.