Worried about an audit of your taxes because you claimed the Employee Retention Tax Credit? Read on to find out if you are at risk for an ERC audit.

On 1/10/24, IRS Commissioner Daniel Werfel announced that the IRS is continuing to improve and automate ERC review procedures and will begin processing new ERC claims in the spring following the moratorium implemented in September. Existing claims are still being processed and eligible businesses can still submit an ERC claim through reputable ERC companies to be processed when the moratorium ends. Visit our full breakdown of the ERC pause for the latest information.

The Employee Retention Tax Credit is putting money back into the pockets of small business owners, but it is also bringing a new worry for employers: the risk of an ERC audit by the IRS.

While an ERC audit is possible, taxpayers who did the math and properly filed their returns likely have nothing to fear. In this post, we’re going to break down employee retention credit audits, including who’s getting audited, why you may get audited, and what to do if you receive a letter from the IRS.

The IRS Is Cracking Down On Erroneous ERC Claims & Issuing More Audits

The IRS has issued multiple warnings about ERC scams and fraud since the beginning of the ERC’s launch. More recently, the increase in ineligible claims has caused the IRS to pause processing new ERC claims completely. (Existing claims are still being processed, albeit more slowly, and new eligible claims can still be submitted. They just won’t be processed until after December 31, 2023).

So what does the ERC pause mean for tax audits?

On September 14, 2023, in the IRS’s statement on the ERC pause, the IRS confirmed that audits are being intensified and the ERC is under increased scrutiny:

The agency announce it was increasingly shifting its focus to review these [ERC] claims for compliance concerns, including intensifying audit work and criminal investigations on promoters and businesses filing dubious claims. The IRS announced today that hundreds of criminal cases are being worked on, and thousands of ERC claims have been referred for audit.

Unfortunately, small business owners are falling victim to these “promoters and businesses” through third-party ERC services.

While there are plenty of reputable ERC companies that can help you claim your tax credit, there are also “ERC mills” that are filing fraudulent claims. These companies accept payment for ERC services and file amended tax returns for businesses that don’t qualify for the ERC. In other cases, these companies are claiming a higher credit than the business is owed.

Taxpayers caught in these scams are ultimately held liable by the IRS. As a result, the business is responsible for repaying the credit, as well as penalties and interest added by the IRS.

Many small business owners aren’t even aware that they were scammed until an IRS audit occurs. This is why it’s so important to know how to spot an ERC scam and to do your research to find a reputable ERC company to file your claim.

The good news is that while the IRS is treating ERC claims with additional scrutiny, that doesn’t mean every single ERC claim will be audited. It also doesn’t mean that claims that are audited will necessarily result in penalties — it might just be that the IRS requires additional documentation to confirm the validity of your ERC claim.

So let’s see exactly which taxpayers and being audited, what to do in the case of an audit, and how to prevent audits to begin with.

Will The IRS Audit ERC Tax Credits?

Any time you submit a tax return to the IRS, there’s a possibility that your return will be audited. Returns with claims for the ERC are no exception.

Because a lot of erroneous claims and illegitimate applications have been submitted for the ERC, the ERC tax credit is being treated with additional scrutiny from the IRS. This doesn’t mean that every taxpayer who claimed the ERC will be audited, but it is likely that more ERC audits will be issued in the coming months.

Having recently been through an audit myself, I know how scary this can be. Deep breath.

Audits can be scary and anxiety-inducing, but if you truly are eligible for the ERC tax credit, you have nothing to worry about. Even if you made an unintentional mistake on your tax return (like I did), working with a tax professional can help you get through the audit with minimal fees and hair loss.

As with other tax audits, the IRS is auditing ERC claims to verify the accuracy of claims and detect fraud. While the IRS hasn’t specifically noted what the organization will be looking for during its ERC audits, we can look at typical IRS tax audits to have a better understanding of what the IRS will be verifying. This includes:

- Eligibility: Was the taxpayer eligible to receive the ERC credit? Did the taxpayer meet all ERC requirements, including having their business fully or partially shut down by the government or a decline in gross receipts? These may be some things that the IRS looks for while performing an ERC audit.

- Accuracy Of Amounts Claimed: The IRS will likely make sure that the taxpayer claims the correct number of employees and an accurate amount for each.

- Other Errors: The IRS may also look for additional errors made by the taxpayer, such as claiming relatives as qualified employees or receiving credits for wages paid for using Paycheck Protection Program funds.

According to a recent news release on the ERC pause, we know that “the IRS may also seek additional documentation from the taxpayer to ensure it is a legitimate claim.” What this documentation is exactly is still unknown, but we will be updating this post regularly as we learn more.

Will Claiming The ERC Credit Automatically Trigger An IRS Audit?

Claiming the ERC tax credit does not automatically trigger an audit from the IRS. While the ERC tax credit is resulting in thousands of audits, according to the IRS, legitimate claims from taxpayers who calculated the proper amount on their ERC refund likely will not see an audit.

How Long Can The IRS Audit ERC Claims?

The IRS typically has three years from the date a return is filed in order to audit the return and assess additional taxes or penalties. This mostly holds true for returns filed with the ERC, with the exception of quarterly returns filed in Q3 and Q4 of 2021. These returns have a five-year statute of limitations.

It’s also important to note that there is no statute of limitations on the IRS investigating a false or fraudulent return filed in an attempt to evade taxes.

What Do I Do If My ERC Refund Is Audited By The IRS?

If your ERC refund is audited by the IRS, the first thing to remember is not to panic.

Getting audited by the IRS doesn’t automatically mean you’ve done anything wrong or that you will certainly face audit fees. Receiving an audit does mean that you’ll need to provide additional information and documentation to verify that you were eligible to receive the ERC and claimed the proper amount.

When I worked with a trusted tax professional during an audit, I was so worried and was told I owed thousands of dollars. My accountant was able to determine that two forms were switched on my tax return; he was able to send this information to the IRS, and the whole thing was resolved with no fees or payments on my end. The moral of the story being don’t panic — sometimes all it takes to resolve an audit is some simple documentation on your part.

Here’s what you need to know if you are audited by the IRS for claiming the ERC.

Reach Out To A Professional For Help First

I highly, highly recommend getting a tax professional’s help with an audit. While you can navigate an audit yourself, the cost was worth the peace of mind to me during my own audit experience.

Additionally, if you filed your ERC with your accountant or with a third-party ERC company, you may already have access to audit protection. If this is the case, you want to reach out right away to your tax preparer, as they will be able to help you with the next steps.

Stay On Top Of Communications & Notices

An IRS audit can be scary, but the worst thing you can do is avoid communications from the IRS in hopes that the problem will go away. Spoiler alert: it won’t. Instead of avoiding the issue, tackle it head-on.

If you are handling the audit yourself, send documentation and communications to the IRS by the requested dates, and don’t hesitate to reach out to the IRS by phone or email if you have any questions or concerns.

If you are handling the audit through a professional, speak with them about any notices you receive from the IRS. If your tax preparer is working as your Power of Attorney in communications with the IRS, they may not want you to communicate with the IRS at all and would instead handle all of the communications for you.

(This was another great reason why I went with an actual tax preparer from my own IRS audit — they handled all of the communication with the IRS for me, so I didn’t have to worry.)

Submit All Necessary Documentation

Whether you are working with a professional or representing yourself during an audit, as part of that audit, you will need to gather documentation that backs up your tax return.

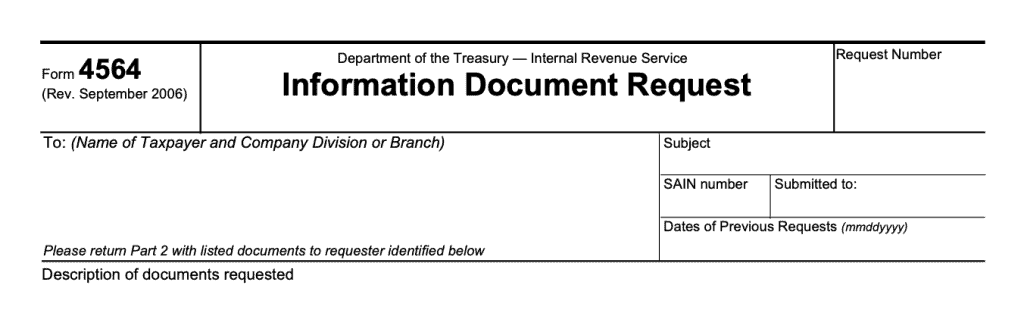

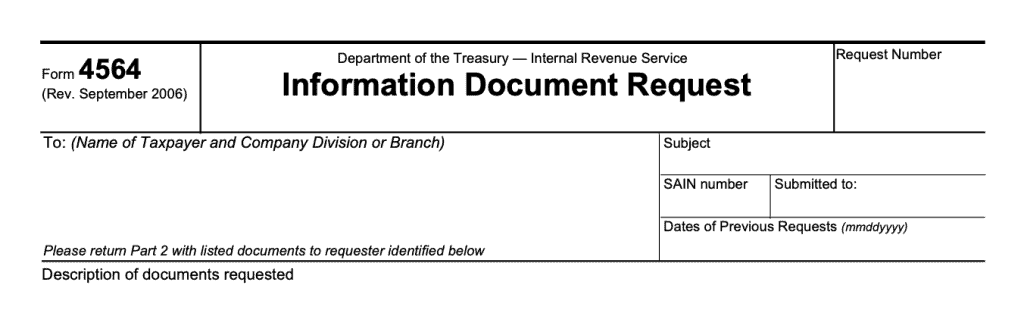

If you’re working with a professional, they will likely provide you with a list of needed documentation. If you are representing yourself, you’ll likely receive an Information Document Request (IDR) that outlines the documentation you need to submit to the IRS.

Documents for an ERC tax audit may include:

- Documentation to prove that your business was fully or partially shut down as the result of a government mandate

- Documentation to show a decline in gross receipts during the period you claimed ERC

- Paycheck Protection Program loan and loan forgiveness documentation

- Payroll records

- Bank statements

- Employment tax records

- General ledgers, trial balances, and other accounting records

- Prior years’ tax records

You will need to gather and submit the required information to your tax professional or to the IRS immediately. Pay attention to and comply with any deadlines on the documents you receive from the IRS.

Be Prepared For Audit Fees For Incorrect Filings

While the hope is that your IRS audit will be resolved without any fees or penalties, it’s important to know that ERC audit fees and penalties do exist.

In addition to preparing your audit documentation, you’ll want to prepare for the worst-case scenario when it comes to audit fees and penalties.

The most likely penalty is a 20% accuracy-related penalty for an inaccurate filing. This 20% accuracy-related penalty applies to the excessive amount claimed or to the underreported tax, not your entire taxable income.

According to the tax attorney firm WiggamLaw:

“You don’t automatically ger an accuracy-penalty if you fail an ERC audit. The IRS usually only applies this penalty if you were negligent about following the tax laws.”

Note: if the IRS finds that you participated in criminal and civil tax fraud, this penalty can rise to 75%.

If you think you will likely be faced with an accuracy-related penalty either because you filed incorrectly or calculated your ERC total incorrectly, now is a good time to start saving the funds for that 20% (or hang on to a portion of your ERC refund just in case until your audit is resolved).

What Do I Do If I Receive An IDR From The IRS?

First things first, if you receive an IDR from the IRS, don’t panic. (Sensing a theme here?) An IDR is simply a formal request from the IRS for additional documents required to confirm your tax return.

IDRs have reportedly been sent to many ERC-claiming taxpayers. The IRS sends ERC IDRs so that they can gather the documents they need to prove that you are eligible for the ERC.

What Is An IDR?

Source: IRS.gov, captured 10/19/2023

AN IDR, or Information Document Request, is a form sent by the IRS to taxpayers when the IRS requires additional information or documentation regarding a tax return.

Does An IDR Always Mean An Audit?

Receiving an IDR notice does not mean you are guaranteed to receive an audit.

While an IDR can increase your chances of an audit, if the IRS gets the information they need from the IDR to verify your tax return successfully, they would have little need to send an audit.

How To Prevent An ERC Tax Audit

While there’s no surefire way of ever preventing an audit when it comes to tax returns, the best thing you can do is file your taxes accurately to the best of your knowledge.

Check over your tax return more than Santa checks the naughty and nice list to make sure you don’t miss any errors or miscalculations. Enlist the help of a trusted accountant or tax preparer — and in the case of the ERC, only work with reputable ERC companies, ideally one that offers audit protection as well.

Also, be sure to keep careful payroll and tax records so that in the event of an audit, you are prepared.

The Bottom Line: Should You Claim The ERC With The Increase In IRS Audits?

If you claim the ERC, there’s a possibility that your tax return may be audited by the IRS. Does this mean you should not claim the ERC credit because you’re worried about an audit — absolutely not!

If you are eligible for the employee retention credit, you should claim the ERC and get the refund your business is entitled to. Don’t let the worry of an audit keep your business from your pretty ERC check.

Instead, make sure you carefully read through the ERC eligibility requirements to understand if you qualify and make sure you calculate your credit amount correctly. Work with a trusted accountant or a verified, secure third-party ERC provider to claim your credit if you want extra peace of mind and support during the ERC application process.

If you’re eligible, you can still retroactively file to receive your tax credits. Check out our other ERC resources to learn more. From determining if you qualify for ERC to calculating your ERC, we’ve got you covered from start to finish. Good luck!

Employee Retention Credit Audit FAQs

What are the IRS penalties for an ERC audit?

If you are audited by the IRS and an error is found with your ERC claim, you will be required to pay back any overage of funds that were distributed to you. You may also have to pay a 20% accuracy-related penalty. If civil fraud is found, penalties rise to 75%. In criminal fraud cases, penalties are even higher and there is a risk of being imprisoned.

What documentation do I need for an ERC audit?

During an IRS audit, the IRS will notify you of the specific information you need to submit. However, some common documentation that you may be required to submit include payroll records, accounting records, PPP loan forgiveness documentation, and documentation that shows your business was fully or partially shut down by the government or proof of a decline in receipts.

Does claiming the ERC increase the likelihood of an audit?

Because of the increased scrutiny on ERC due to an increase in erroneous claims and fraudulent ERC filings, ERC credits are more likely to be audited. However, eligible businesses should still claim the credit. Proper claims are less likely to be audited.