Complete Guide to Square Loans

Square Capital loans give Square users easy access to business funding. Learn more about Square loan fees, requirements, and repayments before signing an agreement.

If you’re a Square seller, you may qualify for a Square Capital loan. These loans are a fast and easy way to get extra working capital for your business, but are they too good to be true?

Read on to learn everything you need to know about Square Capital.

Table of Contents

What Are Square Capital Loans?

Square Capital is a short-term loan service within the greater Square payment processing ecosystem that is available only to Square customers. Here are the basic loan facts for Square Capital Loans:

| Maximum Borrowing Amount | $250,000 |

| Borrowing Fee | x1.10 – x.1.16 amount borrowed |

| Term Length | 18 months maximum |

| Time To Funding | 1-3 days |

| Borrower Qualifications | Square customer in good standing with a growing business and $10,000/year in revenue |

Square loans resemble merchant cash advances in structure, although the rates are significantly better than what you’d typically find in the merchant cash advance world. Traditionally, merchant cash advances required special arrangements with compatible payment processors to withhold a percentage of the customer’s card payments. Square is effectively cutting out the middle man, or more precisely, the middle man is cutting out the funder and directly offering the money to merchants.

Square lends money to its processing customers to help grow their business, the growth of which increases the volume of credit card transactions Square is processing. Square then uses its own processing infrastructure to collect payments and turn a profit on the interest/flat fee.

How Square Capital Loans Work

Let’s take a closer look at how Square Capital loans work.

Square Capital Rates & Fees

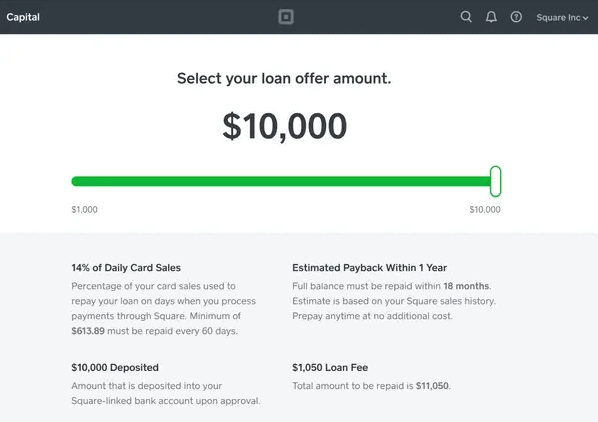

As is typically the case with short-term lending, Square uses a flat fee structure rather than an interest rate. This means that the amount you pay in excess of the principal (the amount you borrow) is simply a multiple of the amount you borrow. In Square’s case, this multiple ranges between 1.1 and 1.16.

Let’s say you borrow $10,000 from Square at a 1.12 rate. You’d owe a total of $11,200 ($10,000 x 1.12). In this example, your loan costs $0.12 for every dollar you borrow.

Total Cost = Borrowed Amount X Factor Rate Multiplier

This is the only fee Square Capital charges beyond whatever you’re paying for other Square services.

How To Repay Your Square Capital Loan

Since you’re already processing your sales through Square’s payment infrastructure, Square claims a percentage of your daily sales.

Because your daily sales vary, the amount you’ll repay on any given day varies. That’s why there’s no set term length. If sales are booming, you’ll repay it quickly. If they’re sluggish, it’ll take longer. If you haven’t paid off the loan within 18 months, any remaining balance will immediately be due in full.

How To Get A Square Capital Renewal

One major point of frustration for Square Capital users is renewals. When they’re nearing repayment or have repaid the loan in full, some borrowers have simply been waiting for Square to extend another offer to their business and get frustrated if that offer does not come.

On the Square seller community, representatives state that you might be extended a new offer when your current loan is more than 75% paid off. Unfortunately, this is a passive process. It’s possible your business might not fit what the company is looking for, even if it’s doing as well as (or better than) it was when you received your last loan. If you need capital and haven’t received a Square Capital offer, consider looking elsewhere for business funds.

Square Capital Borrower Eligibility Requirements

Square Capital’s requirements are:

- Must be a Square customer

- Annual revenue of at least $10,000

- Growth in sales

- A mix of returning and new customers

The following issues may disqualify you:

- You have a lot of chargebacks.

- You process a lot of failed debits.

- You have multiple Square accounts.

Square Capital Application Process

Rather than apply for a loan, Square monitors your account and decides whether to extend credit to you. If your account is eligible, you’ll receive a notification by email and an alert on your Square account. If you’re interested in the loan offer, follow the attached instructions, choose your loan amount from the available options, and await processing.

Square should already have a lot of your information on file, so you’ll only be contacted for more information if there’s anything missing. Further, Square does not perform a credit check. This makes it a great option for borrowers with bad credit or borrowers who don’t want their credit scores impacted by a credit inquiry.

Once approved, Square will usually deposit the funds on the next business day, although it can take up to three days for the funds to show up in your bank account.

How Square Capital Compares To Other Lenders

Comparing Square Capital to other lenders that use factor rates is fairly straightforward, but it can be a little difficult to compare the company to lenders that use interest rates.

Our Merchant Cash Advance Calculator can give you an estimated APR as well as other information, such as your total cost of borrowing and estimated daily payment. Although Square Capital is technically a loan, the merchant cash advance calculator is the best fit because Square Capital loans do not have a set repayment date.

For a more thorough explanation of calculating APR on short-term funding, check out Short-Term Loans, Merchant Cash Advances, & APRs. Now, let’s look at some popular short-term funding alternatives to Square Capital.

Square Capital FAQs

Final Thoughts

Square Capital is an easy-to-understand, convenient loan product for Square users. Although the fees can be a little expensive, they’re still generally comparable to or better than those of its competitors.

Check out our full Square Capital review for more information on this loan. Or, if you’re looking for something a little different than Square Capital, check out our top picks for the best small business loans.