A high effective rate means your credit card processor is taking too much of your business's hard-earned revenue. Find your effective rate to determine if you're paying too much for processing.

Our content reflects the editorial opinions of our experts. While our site makes money through

referral partnerships, we only partner with companies that meet our standards for quality, as outlined in our independent

rating and scoring system.

To keep your business’s payment processing expenses pruned to a minimum, one of the first things we do is calculate your effective rate. Once we find the effective rate, we can determine if you are paying too much to accept credit cards.

If you do find that your effective rate is too high, you’ll want to consider our list of the best credit card processors. These companies are free of the bigger red flags you’ll want to look out for, and they all have excellent pricing transparency.

But first, let’s define “effective rate” and show you how to calculate your effective rate for payment processing.

What Is Effective Rate?

Effective rate is the total processing fees divided by total sales volume on your business’s credit card processing statement. It’s usually expressed as a percentage, and it’s one of the quickest ways to uncover if you’re paying too much for your merchant account.

Another way of thinking of your effective rate is a combination of interchange fees, plus your processor’s markup. Interchange fees are the wholesale credit card processing price of your transactions, which cannot be avoided. However, processor markups can vary considerably from one company to the next.

How To Find The Effective Rate For Your Processor

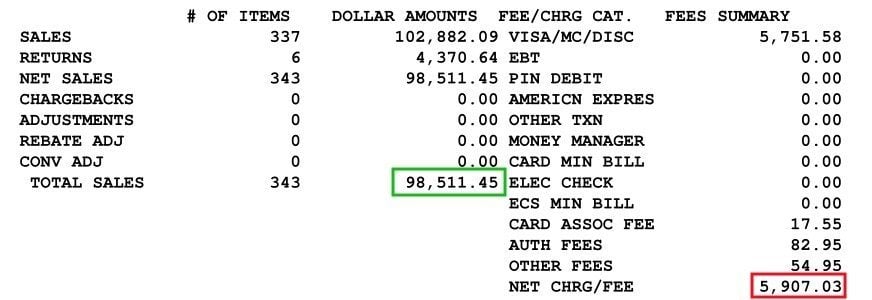

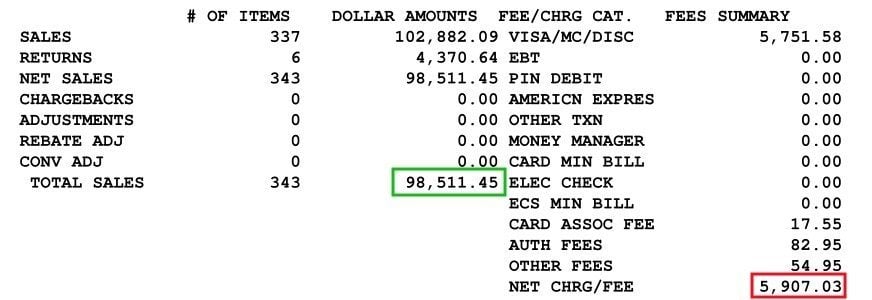

To find the effective rate for your credit card processing, you first need to round up all of the fees on your statement and add them up. We’ll use the following statement as an example:

In the example above, we’ve highlighted the total sales volume in green, and the total fees in red.

So, what is the effective rate for this statement? If you figured out 5.99 or 6% (rounded) you would be right. To find the effective rate, you divide the total sales by the total fees:

$5907.03 / $98511.45 = .0599 or 5.99%.

To get the most accurate effective rate, it is helpful to have at least three consecutive months of statements since certain fees, such as billback, won’t appear in every statement.

Let’s say your average effective rate over three months is 6%. But what does this 6% mean in the context of payment processing?

What Is A Good Effective Rate For Credit Card Processing?

Generally speaking, a good effective rate for credit card processing is around 2-4% — I share that figure to give you a starting range for the “red-flag area.”

With that being said, there also may be some legitimate reasons your rate inches beyond that.

Reasons For A High Effective Rate

In some cases, a high effective rate cannot be avoided–for example, if your business is classified as high-risk–while in other cases, your processor just might be charging you a lot of junk fees.

It’s also worth pointing out that the only way you can clearly see the various fees that your merchant services provider is charging you (the markup separated from the interchange fees) is with a transparent pricing plan like interchange-plus.

Here are some common reasons you might have a high effective rate for credit card processing.

High-Risk Industry

High-risk merchants can be defined by industry, and if you are considered high-risk, you should expect to pay higher rates to process their transactions, regardless of what the interchange rates are.

Hidden Or Junk Fees

Remember, the effective rate takes into account total fees, not just interchange rates and rate markups. You could have hidden fees or incidental fees for that particular month.

Check out our complete guide to credit card processing rates and fees to learn more about all the potential fees involved in card processing.

Small Average Ticket Size

Businesses with very small average tickets are often hit hard by the flat, per-transaction piece of an interchange rate or processing rate.

For instance, if you sell very small-ticket items, the effective rate on a flat-rate plan could be higher than it could be before any other fees are counted.

International Transactions

Card brands like Visa and Mastercard also charge some wholesale transaction fees, but these are typically much less than interchange. The exception is for international charges, particularly if currency conversion is involved.

If your processor passes cross-border assessments through on the statement, this is added on top of all other normal fees and rates.

Downgrading

Downgrading means that transactions are getting bumped into higher-rate tiers for any number of reasons (most of which are completely out of your control).

If you’re on a tiered pricing plan, we’d check to see costs on qualified vs non-qualified credit card transactions. We recommend steering clear of tiered pricing plans because the fees can get muddy and these plans are usually overpriced.

Other Types Of Fees

If you’re on a more transparent cost-plus model (like interchange-plus or subscription pricing) you can also examine your statement in more detail to look at any specific fees like annual fees.

You also want to identify if your team is manually keying in transactions, which almost always cost more to process and should be avoided if possible.

Additionally, security fees could also contribute to your overall effective rate. And to add to all that, you may identify other rogue fees that may not have been clearly disclosed if you were lulled by a “teaser rate.”

How To Find The Best Merchant Services Rates

Now that you have a better idea of what might contribute to your effective rate, the value comes in using this data to find the best rates on credit card processing for your small business.

When it comes to looking for the best merchant services providers that offer the most affordable pricing, you’ll want to find companies that meet the following criteria:

- No early termination fees

- Month-to-month agreements rather than long contracts

- No or small PCI compliance security fees

- Clearly published rates

- No junk fees or bait-and-switch tactics (We look at customer reviews to uncover these.)

Suppose you really like a feature set, but you aren’t sold on all the pricing details or other particulars. In that case, we encourage you to advocate for yourself before signing a merchant agreement and learn how to negotiate a credit card processing deal.

The Bottom Line On Effective Rate: Do The Math

By now you’re probably feeling more empowered to take the reigns and make better choices for your small business.

To recap, if you’re fuzzy on what you’re paying in payment processing fees, the first step is to get yourself at least three statements, add up your total fees and divide that figure by your total sales.

Should you find that your effective rate is over 4%, you might want to find a new processor or negotiate a lower rate.

If you want to learn more about all the miscellaneous merchant services fees that make up your effective rate, read our guide to analyzing your processing statement in full.