Pros

- No minimum balance requirements

- Open to all business types

- Allows cash deposits & mobile check deposits

- Impressive integrations

- Easy-to-use website & mobile app

Cons

- No traditional savings accounts

- Some fees on free accounts

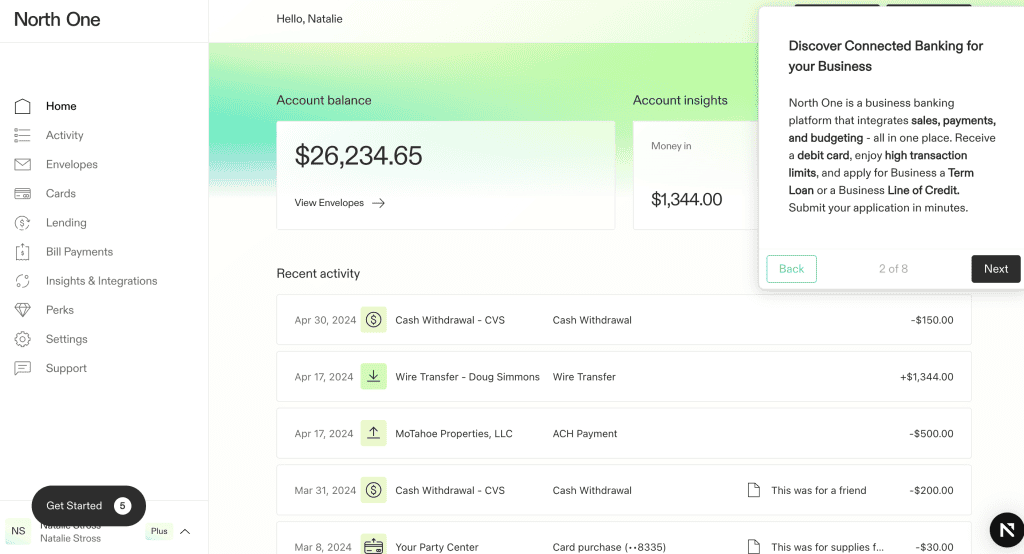

What Is North One?

North One is a fintech company offering online business banking through FDIC-insured checking accounts and Mastercard debit cards to business customers.

North One accounts include ATM access, cash deposits, a strong mobile app, no account minimums, and an impressive number of integrations. There are also lending services available for businesses that want to manage their banking and small business loans or lines of credit with one single company.

Services Offered By North One

North One primarily specializes in checking accounts. While we wish that the company also supported savings accounts, there is a savings envelopes feature to help you organize the money in your account.

We were happy that North One has added business lending services for businesses interested in managing business checking and business funding with the same company.

Here are all of the services you’ll find with North One:

| North One Accounts Offered |

Value |

| Checking |

|

| Savings |

|

| High-Yield Savings |

|

| CDs |

|

| Treasury Accounts |

|

North One Rewards & Perks

With the North One Mastercard® Small Business Debit Card, you can earn:

- 4% cash back at restaurants

- 4% cash back at hotels

- 1% cash back at gas stations

If you sign up for North One Plus, you’ll get 1% cash back on all purchases.

| North One Yield and Cashback |

Value |

| Checking APY |

1.5% - 3.0% |

| Savings APY |

N/A |

| CD APY |

N/A |

| Treasury Account APY |

N/A |

| Checking Cashback |

1% - 4% |

Additionally, North One has negotiated free trials and discounts from various software partners and created seamless integration processes. The selection of integrations is probably the biggest thing that sets North One apart in the online banking scene.

Currently, North One says these perks amount to $29,000 in savings for business owners. You can view a full list of North One’s software discounts and perks on their website.

Supported software partners include PayPal, Stripe, Square, Etsy, Shopify, Airbnb, Amazon, Venmo, Uber, Lyft, and more.

North One Fees

North One offers two different bank plans: North One Standard and North One Plus.

| North One Plans |

Price |

When To Use |

| North One Standard |

$0/month |

If you want a basic checking account with no monthly fee and don't mind occasional ACH payment and wire transfer fees |

| North One Plus |

$30/month |

If you need no fees on ACH, physical checks, bill payments, or domestic incoming wire transfers |

If you don’t opt for the Plus plan, the fees on the Standard plan are pretty high compared to many of the best online business checking accounts that have no monthly fees and often have very few additional fees.

Here’s a breakdown of the fees:

| North One Category Fees |

Value |

| Monthly Fee Range |

$0 - $30/month |

| Monthly Checking Fee |

$0-$30/month |

| Monthly Savings Fee |

N/A |

| ATM Fee |

None |

| Overdraft Fee |

None |

| ACH Fee |

0% - 1.5% |

| Incoming Domestic Wire Transfer Fee |

$0 |

| Outgoing Domestic Wire Transfer Fee |

$15 - $20 |

| Incoming International Wire Transfer Fee |

N/A |

| Outgoing International Wire Transfer Fee |

N/A |

| Wire Transfer Fee Start Point |

$0 |

| Wire Transfer Fee Range |

$0 - $20 |

| Cash Deposit Fee |

Varies |

| Foreign Transaction Fee |

0% |

| Excessive Transactions Fee |

None |

| Stop Payment Fee |

$4 |

North One Eligibility Requirements

North One business bank accounts are available to all kinds of businesses, including sole proprietorships, partnerships, limited partnerships, LLCs, corporations, and joint ventures. North One especially appeals to small businesses and freelancers, with easy eligibility requirements and no minimum balances.

However, North One maintains a fairly typical list of excluded businesses that will be ineligible for North One business banking services.

Because North One is an online-only bank, applications are processed entirely online. Account holders must be:

- At least 18 years old

- A US citizen or legal resident of one of the 50 states or of the District of Columbia or “a resident of Canada who owns a legally incorporated U.S. entity”

- Have a verifiable US street address (no PO box)

North One Application Process

North One doesn’t provide a ton of information on its application other than you may be required to provide personal identification when you apply, including your name, address, and date of birth. The application process is online and the application process has no impact on your credit score.

North One’s applications are processed in real-time, so you could be approved in just minutes.

Once approved, there is no minimum deposit required.

North One Business Banking Features

North One is loaded with features that will appeal to small and mid-sized businesses.

What North One does offer is notable: numerous integrations with popular business software that can help you connect your finances and make accounting easier. If you connect your POS, for example, North One even makes it easier to access your cash, delivering almost instantaneous access to funds from sales.

While we think it’s a shame that North One doesn’t include traditional savings accounts, we appreciate North One’s Envelopes feature that allows businesses to set aside money for rent, taxes, payroll, and other regular expenses as well as for unplanned expenses and emergencies. You can set up as many Envelopes as you’d like and can even automatically direct a percentage of your money on a daily, weekly, or monthly schedule.

Here are some of the key features North One offers:

| North One Features |

Availability |

| Incoming Domestic Wire Transfers |

|

| Outgoing Domestic Wire Transfers |

|

| International Wire Transfers |

|

| ACH |

|

| ATM |

|

| Cash Deposits |

|

| Mobile Deposits |

|

| Check |

|

| Virtual Cards or Digital Wallet |

|

| Bill Pay |

|

| Cash Flow Management |

|

| Reporting |

|

| Standard FDIC Insurance |

|

| Invoicing |

|

| Accounting Integrations |

|

North One’s transaction processing time and transaction limits will depend on which North One account you have. North One boasts high transaction limits to help businesses successfully manage their finances. The best place to find the specifics is in your North One account agreement.

It’s worth noting that there are several customer reviews reporting long check deposit time frames.

North One Sales & Advertising Transparency

For the most part, North One is pretty transparent when it comes to features, fees, and rewards. Finding information on eligibility requirements takes a bit more work, but the details are there if you look (the FAQ section on the North One help center or the company’s account agreement documentation are good places to look). There is not as much detail on the specifics of the North One application process, which we hope to see the company address.

One huge positive worth noting is that North One is one of the only business banks I’ve seen that has a free guided demo available online. I found this to be a great touch and super helpful for anyone wanting to see the company’s interface before signing up for a bank account.

North One Customer Service & Support

North One has a solid number of customer support options, including email, live chat, an extensive help center, and more. Businesses that opt for the North One Plus plan get an even better support experience with a dedicated support rep and onboarding assistant.

Many of the positive North One reviews mention customer service. One user says North One “made me feel like family,” and another calls North One’s service “the friendliest, quickest, and most helpful customer service I’ve ever interacted with.”

Compared to other online-only business banks, North One stands out by providing live customer service options, though the company’s support hours are more limited than some with support available from M-F 9:00 AM – 6:00 PM.

North One Customer Reviews

North One receives predominantly positive customer reviews across popular review sites like TrustPilot and on app stores. North One is accredited by the Better Business Bureau and has an A+ rating there (previously, they were rated at a B).

Most users who post on the BBB website do so because they have a complaint, so we weren’t surprised to see a higher level of complaints listed there. We do note that North One seemed to provide personal responses to each complaint and resolved several of them.

Negative North One Complaints

- Account denials

- Holds on funds

- Long check processing timeframes

- Monthly fee

- Limited banking features

Positive North One Reviews

- Outstanding and responsive customer service

- Easy to use

- Good self-help resources

- Useful integrations

- Good mobile app

Is North One Safe?

Because North One is not a bank, it partners with The Bancorp Bank, member FDIC, to offer FDIC protections to North One customers. Deposits in North One’s business bank account are FDIC-insured to the full legal limit of $250,000.

North One also has several security features in place to protect customer data including Face ID or Touch ID logins, fraud monitoring, and card controls.

Final Verdict: Is North One Business Banking Worth It?

In the world of fintech banks, every bank is trying to make a name for itself as one of the best. With North One, the thing that sets it apart is the exceptional customer service and the number of integrations. The software is also easy to use and has a great mobile app. Competitive APY, loans and lines of credit, and cashback rewards round out what makes North One a top choice.

However, there are some drawbacks to consider. You’ll have to upgrade to a paid plan to eliminate some fees, and there’s also no savings option, though there is a helpful savings envelope feature.

If you’re still shopping around, take a look at our best online business bank accounts for more options. Or, if you’re interested in comparing North One to other checking accounts, check out our list of the top business checking accounts.