Pros

- Easy to use

- Scalable

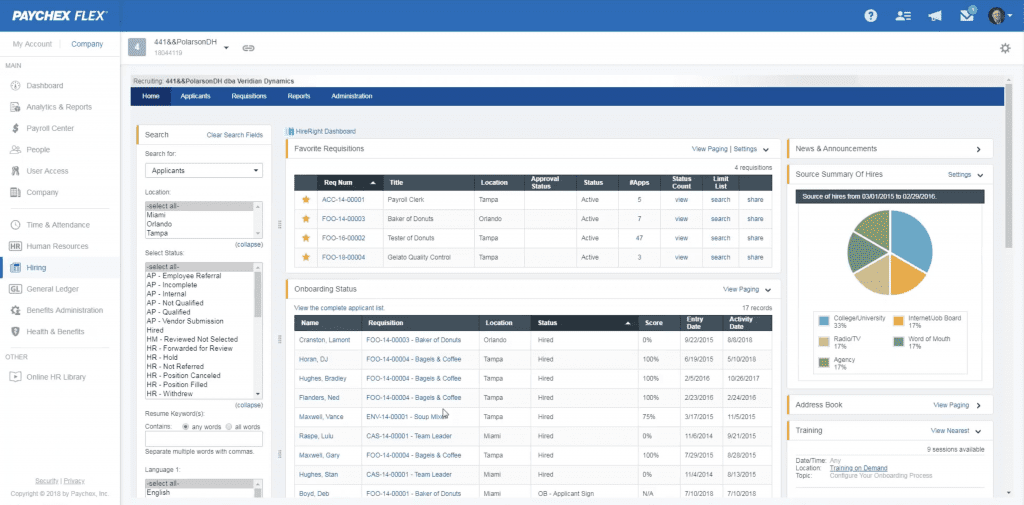

- Built-in onboarding and HR

- 2 days (can pay for faster processing times) payroll processing available

- Valid in all 50 states

Cons

- Non-transparent pricing

- Has many extra fees

What Is Paychex?

Paychex is cloud-based payroll and HR software that provides payroll, HR, benefits administration, business insurance, retirement plans, health care, and more for small to enterprise-sized businesses.

Paychex’s most impressive features include strong employee management tools, direct deposit, 100+ reports, payroll processing in 2 days (can pay for faster processing times), and employee onboarding support.

The downsides are limited information about the software’s security and numerous user complaints about unfiled taxes.

Paychex Pricing

Paychex’s low 2.2/5 star rating was driven down by its lack of full pricing transparency, no free trial, and limited pricing customization options. Compared to similar solutions, such as Gusto or QuickBooks Online Payroll, we think Paychex’s starting pricing plan is affordable, but very limited by its employee cap.

Contact Paychex directly for pricing details on other plans.

Paychex’s base plan’s pricing is consistent with plans offered by other payroll software on the market. However, Paychex charges per payroll run, including off-cycle runs. We found one location on Paychex’s website where it stated that payroll options started at $39/month + $5/employee.

Fortunately, there are no contracts with Paychex, so you can cancel your plan anytime.

| Paychex Plans |

Price |

When To Use |

| Flex Select |

Custom |

If you need a dedicated payroll specialist to walk you through your payroll runs |

| Flex Pro |

Custom |

If you need accounting software integrations for your payroll software |

| Flex Enterprise |

Custom |

If you need advanced HR solutions, analytics, and insurance setup support |

Paychex Flex Select

Paychex Flex Select’s pricing is unpublished. The plan includes:

- Dedicated payroll specialist

- Paper checks, check-signing, or check logo services

- eLearning platform access

- Direct deposit

- Check-printing

- Free mobile app

- Employee self-service

- Reports

- General ledger service

- Garnishments (available as an add-on)

- Payroll tax support

- W-2s

- 1099s (extra cost)

- New-hire reporting

- Workers’ compensation insurance (available as an add-on)

- Compliance posters

- HR resource library and forms

- Financial wellness programs

- Tax credit services

- Employee paycards

- Employee assistance program

Paychex Flex Pro

Paychex Flex Pro’s pricing is not published. The plan includes everything from Flex Select, plus:

- Accounting software integrations

- State unemployment insurance services

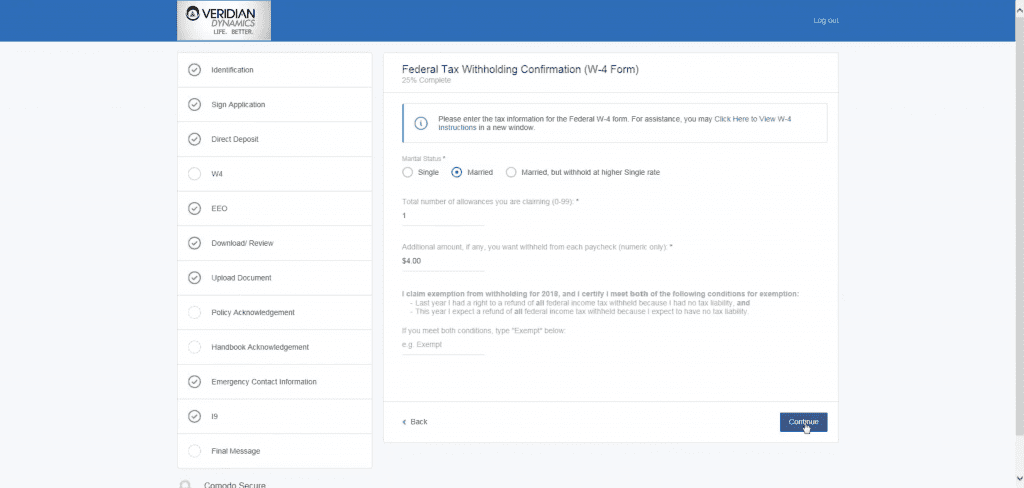

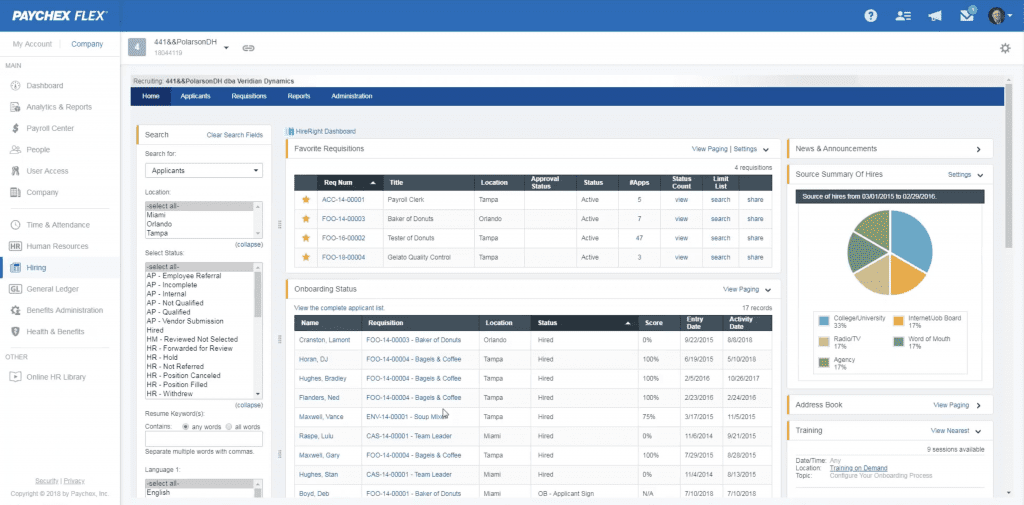

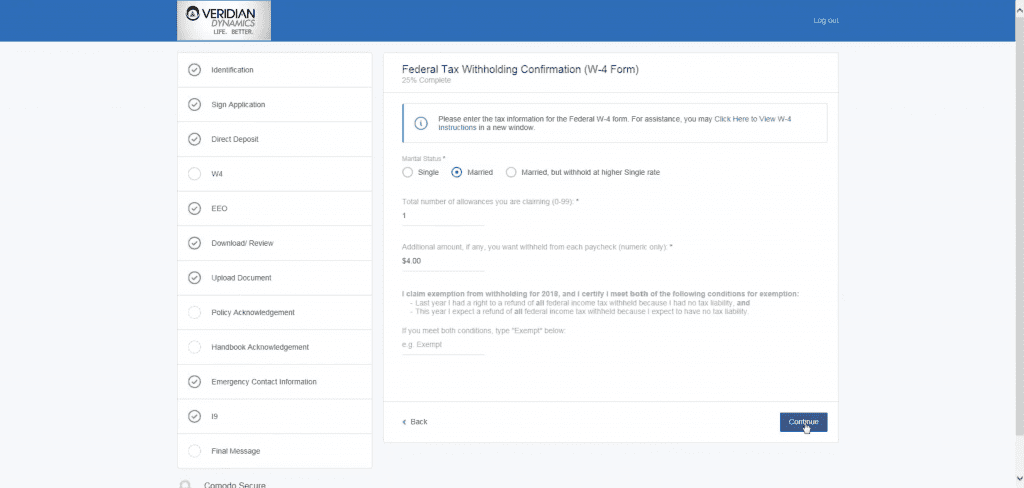

- Onboarding tools

- Pre-employment screening

- Employee handbook tool

Paychex Flex Enterprise

Paychex Flex Enterprise’s pricing is not published. The plan includes everything from Flex Pro, plus:

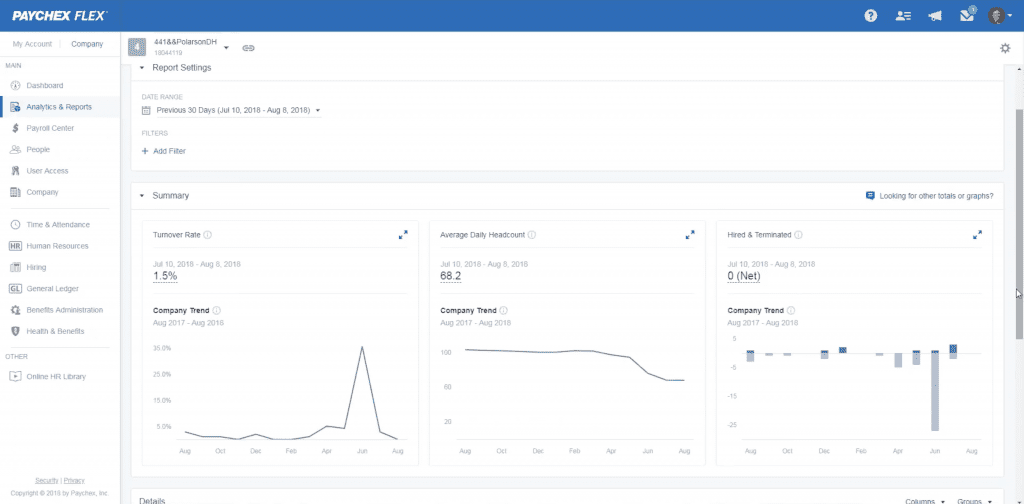

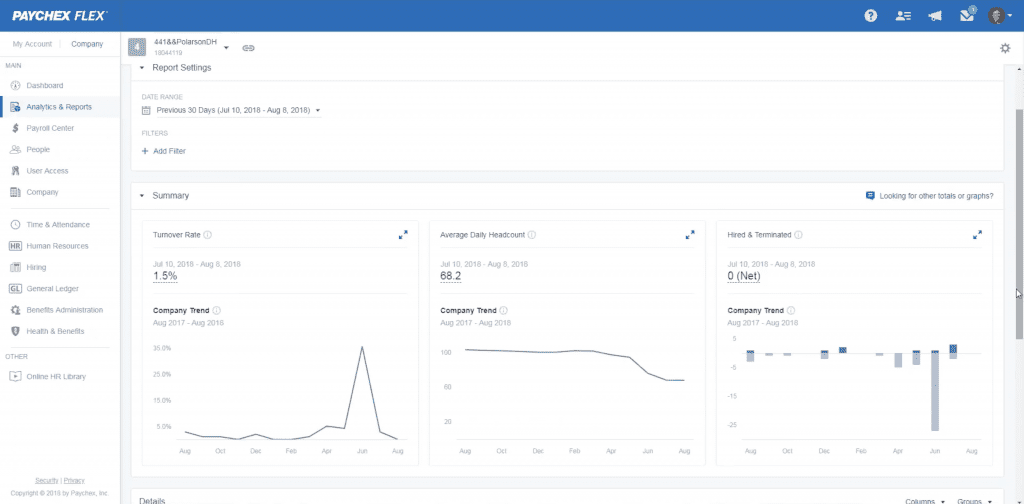

- Custom analytics and reporting

- HR administration

- Online employee training

- Employee handbook resources

- Onboarding essential tools

- Custom analytic tools

- Professional support setting up SUI and workers’ compensation

Extra Paychex Costs & Fees

Paychex offers an incredible number of services, such as time tracking, business insurance, hiring services, payment processing, and more. Most of these services will integrate directly with your payroll dashboard, so you can manage many areas of your business in a single spot.

Unfortunately, Paychex’s extra costs and fees for these services get into nickel-and-dime-ing territory compared to other similar payroll software options. That said, the modular approach to business solutions allows larger businesses with sizable budgets to pay for only the services they need.

Is Paychex Easy To Use?

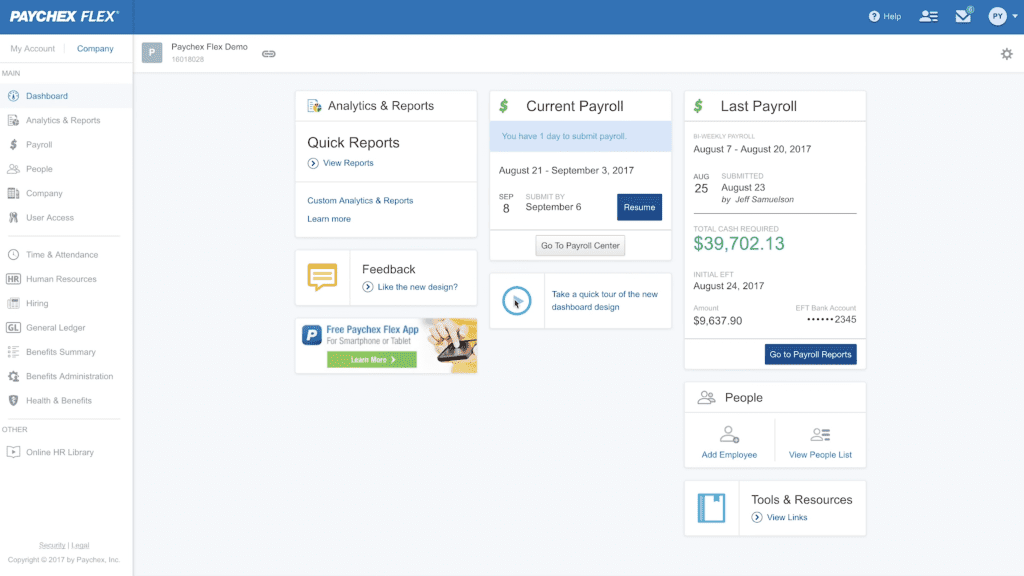

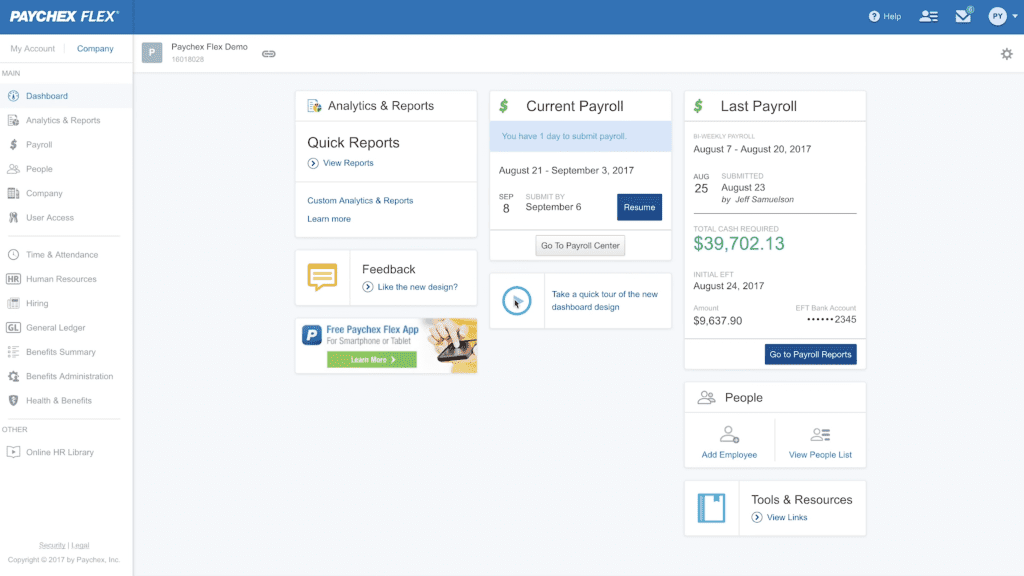

With a 4.4/5 star rating, Paychex earned good marks in the ease of use category. The software performed well when rated for its everyday use, integrations, and reliability but lost marks due to first-time setup limitations that could make the process a little cumbersome, plus some customer complaints about glitching.

Paychex’s UI is generally well-organized, contributing to the software’s ease of use. Each major feature has its own place on the sidebar for easy access, and all Flex plans include a designated support specialist to help if you get stuck.

Paychex handles the entire implementation process for you on higher plan tiers. The Paychex team will enter all of your data for you and get your account set up correctly so you can be ready to run your first payroll within a few days or weeks, depending on the size of your business.

Paychex is cloud-based, so no downloads or installation is required.

Paychex Features

Paychex scored an impressive 4.6/5 star rating in the features category, as the software boasts payroll processing essentials, HR solutions, and time-tracking features all in one.

Additional charges for faster payroll processing and multistate payroll caused the software’s rating to drop. Further, the lack of a DIY tax plan, automated payroll processing, and some limits to benefits broker management rounded out the software’s dropped points.

| Paychex Features |

Availability |

| Payroll Tax Support |

|

| Auto-Schedule Payroll |

|

| Bonus Payroll |

|

| Off-Cycle Payroll |

|

| Employee Management |

|

| Paid Time Off |

|

| Time Tracking |

|

| HR Support |

|

| Onboarding Support |

|

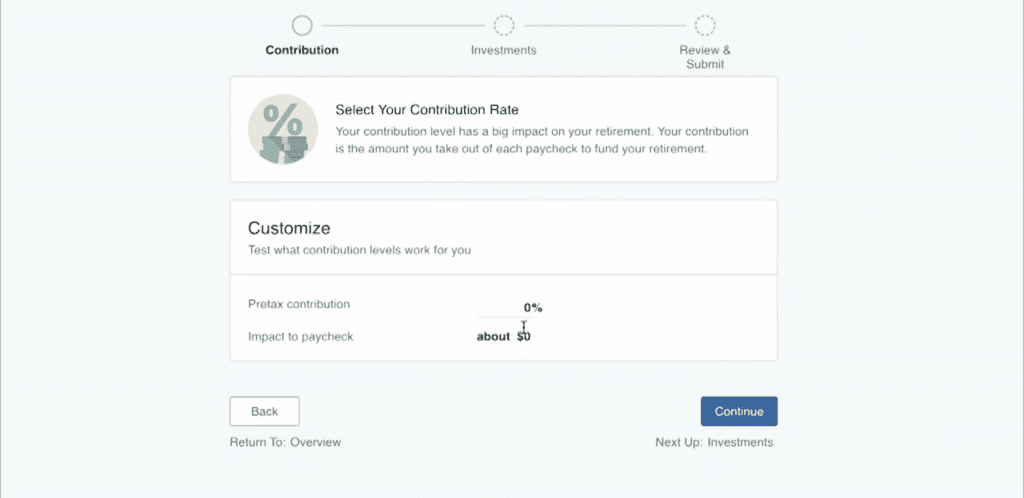

| Benefits Administration |

|

| Number Of Reports |

100+ |

| Number Of Integrations |

270+ |

| Number Of Users Supported |

1-1,000+ |

Ultimately, Paychex offers a robust suite of payroll features and solutions that are consistent with similar payroll software solutions.

Compared to other payroll software, Paychex is most similar to ADP in that it has a comprehensive feature set and extensive HR support. Check out our ADP vs. Paychex comparison for a breakdown of the differences between the two software options.

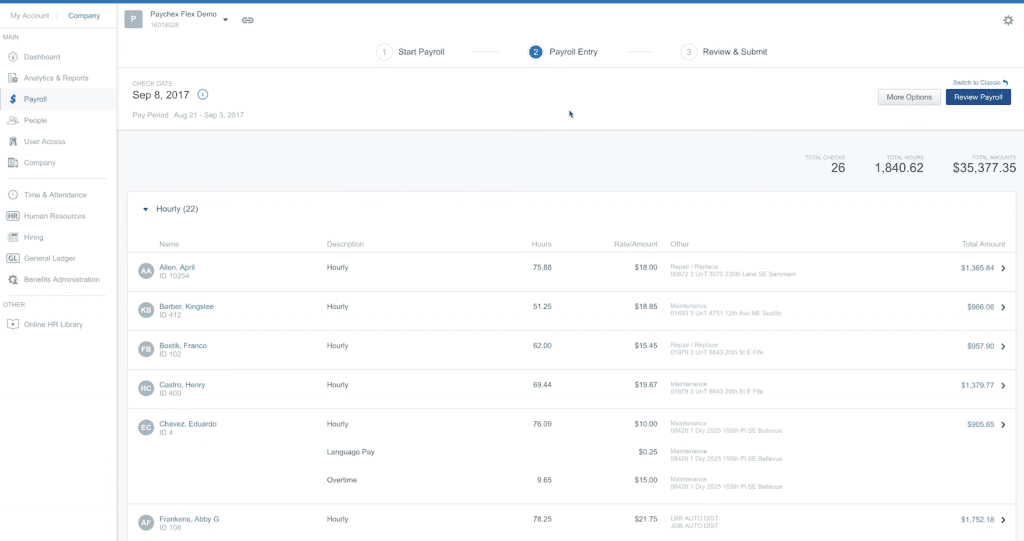

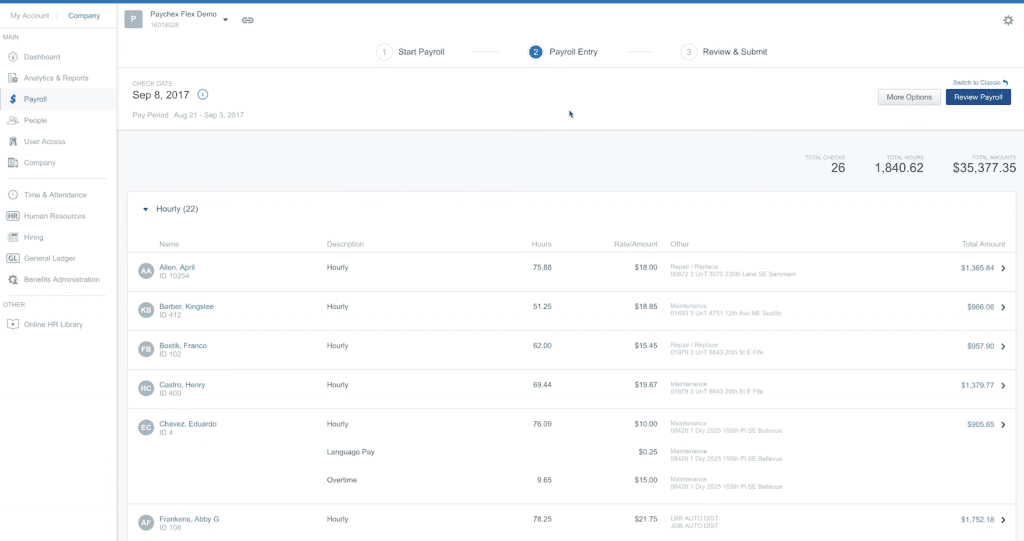

Payroll Processing

Paychex payroll processing takes two days (with faster options available at an extra cost). The software allows you to work on multiple payrolls at once, including future payroll, and you can run payroll from any device.

Some of Paychex’s most notable payroll processing features include:

- Mobile app

- Two-day payroll processing

- Same-day and ACH processing (extra cost)

- Direct deposit

- On-site check-printing

- General ledger report

- Multiple pay rates

- Off-cycle payroll (extra cost)

- Garnishments (not available for Flex Select)

- Dedicated payroll specialist (Flex Select and up)

- Accounting software integration (Flex Pro and up)

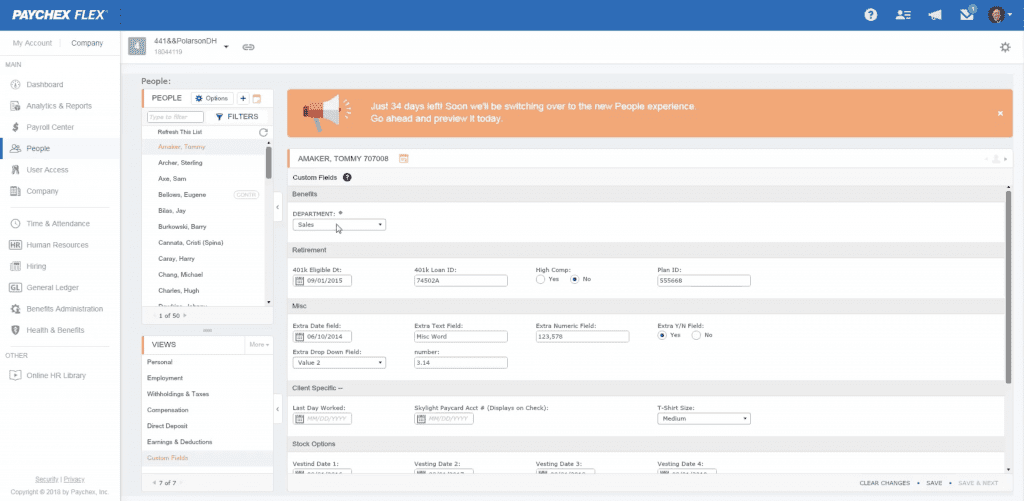

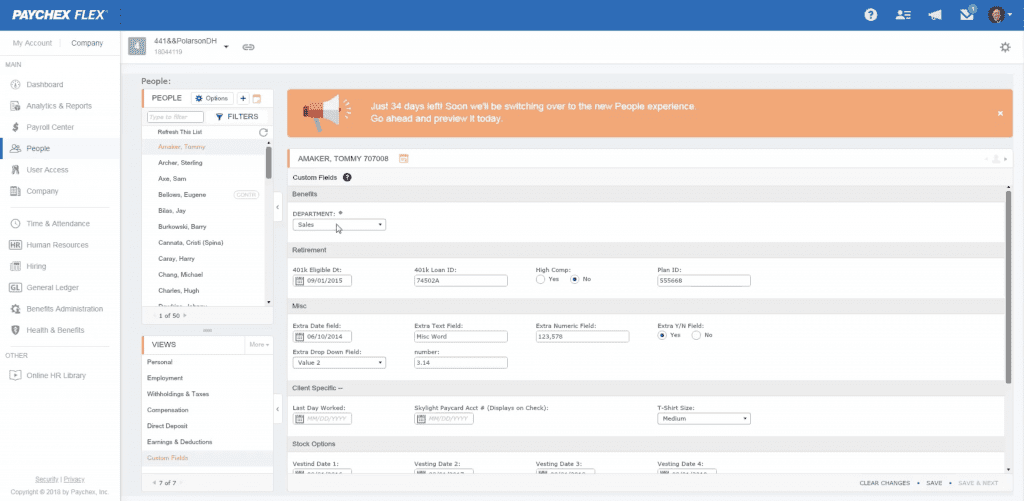

Employee Management & PTO

Paychex’s employee management feature is quite advanced and allows you to record personal information, employee history, direct deposit information, and more. You can add multiple employee pay rates and easily manage earnings and deductions.

Here’s a look at Paychex’s employee management and PTO features:

- Employee profiles

- Custom fields

- Employee portal

- Employee pay stub access

- PTO management (requires Paychex Time & Attendance add-on)

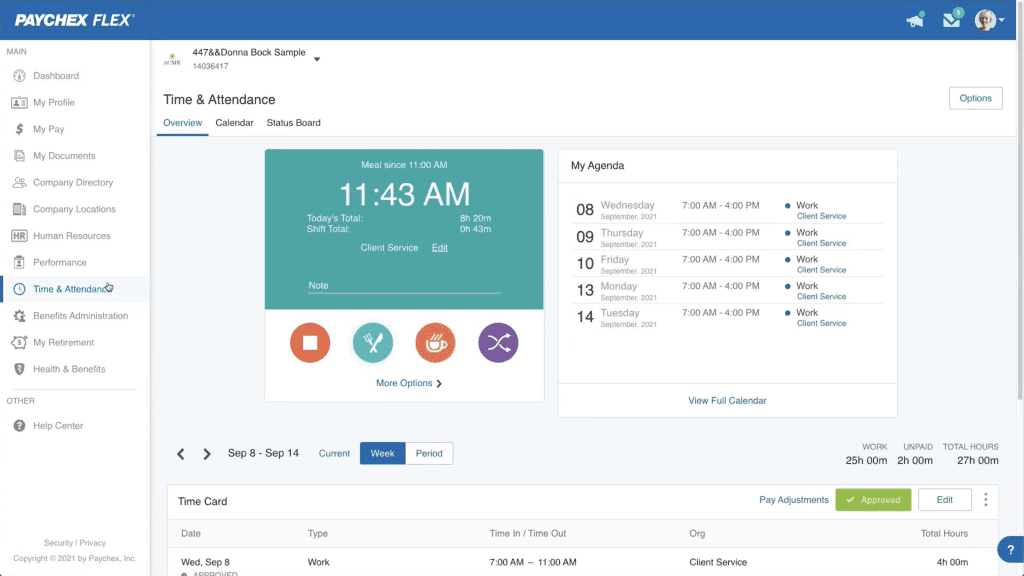

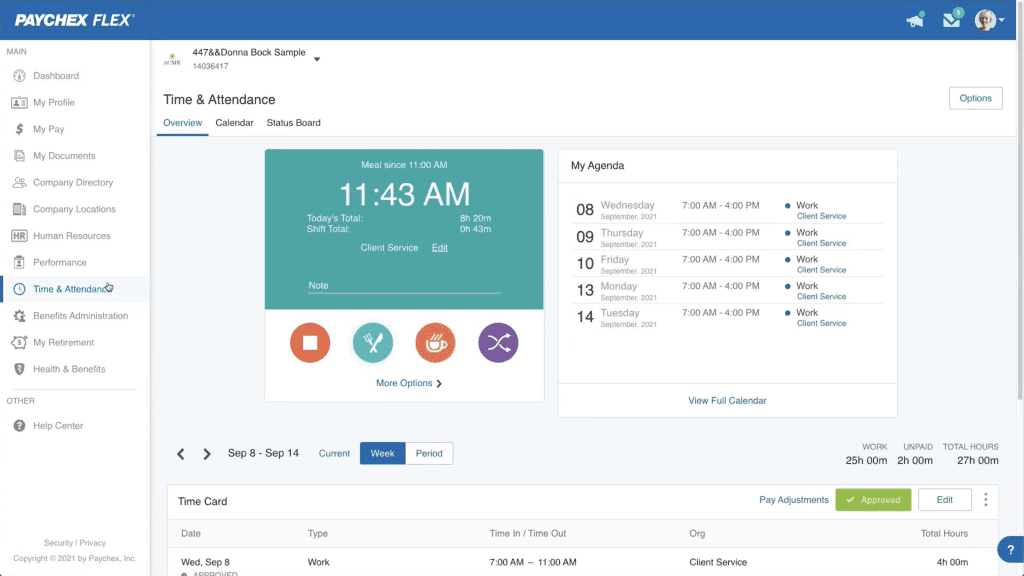

Time Tracking

Paychex’s time-tracking features are limited to its add-on Flex Time. With the Flex Time add-on, you can manage your employee attendance and schedules anywhere you have internet access.

Paychex’s time tracking features include:

- Multiple time collection methods

- Employee self-service via mobile app

- Manage meals and breaks

- Timecard management

- Scheduling support

- Overtime rules

- Calendar integration

- Geolocation and geofencing

- Attendance alerts (Flex Time)

- Tips and reimbursements

Payroll Tax Support

One of the best parts about Paychex payroll is that the company will handle calculating and filing your payroll taxes for you. The most notable payroll tax support features of Paychex include:

- The calculation, filing, and payment of federal, state, and local payroll taxes (may incur fees)

- W-2 tax form

- 1099 tax forms (extra cost)

Reporting

Paychex offers upwards of 100 reports and advanced analytics for customers on its Flex Enterprise plan. The software’s reporting feature highlights include:

- 100+ reports

- Customizable reports

HR & Onboarding

Each Paychex Flex plan includes a basic HR section where you can store key documentation. These plans also include a labor poster kit. However, you’ll need to upgrade to the Flex Enterprise plan to start using some of the software’s more advanced HR features, such as performance reviews and tracking employee training.

Here’s a look at some of Paychex’s HR and onboarding features:

- New-hire reporting

- Financial wellness course

- Elearning portal (Flex Select and up)

- Onboarding tools (Flex Enterprise only)

- Employee screening (Flex Enterprise only)

- Employee handbook tools (Flex Enterprise only)

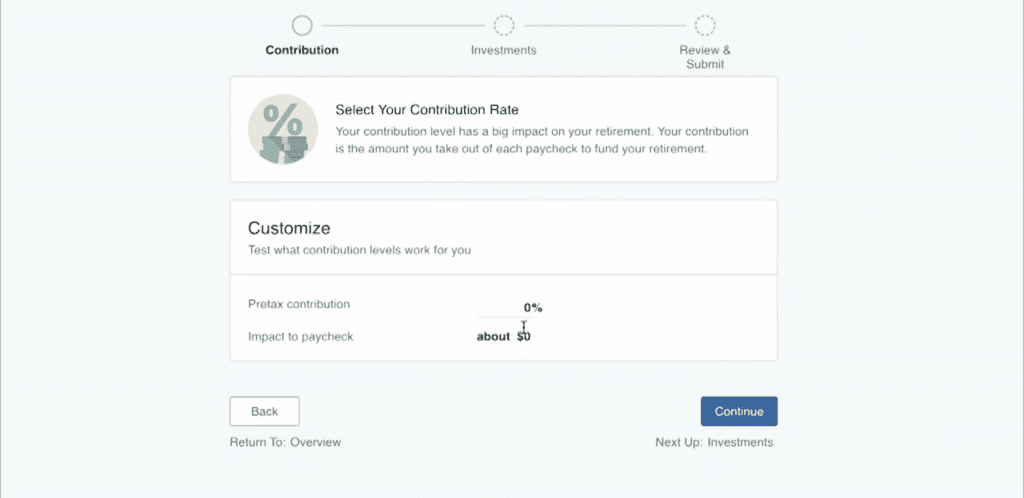

Benefits Administration

Paychex offers employee benefits as a separate service within the platform’s ecosystem. If you opt for this service, you’ll be able to give your employees benefits spanning from health insurance to retirement plans.

Here’s a look at what you can expect from Paychex’s benefits administration services:

- Integration with Paychex Payroll

- Medical contribution tracking

- Enrollment tracking

- 401(k) retirement accounts

- Health insurance benefits

- Dental and vision benefits

- Employee portal for benefits management

- Flexible spending accounts

- Health savings accounts

- Tax savings plans

Paychex Customer Service

Paychex’s 3.8/5 star rating in the customer service category reflects the software’s wealth of customer support options, especially its 24/7 live support. Access to Paychex’s knowledgebase is limited to its users, but from what we could find, the content was helpful enough.

However, Paychex’s customer service rating was lowered by its limited training and support for its software, though it does offer plenty of HR training options. Mixed reviews about Paychex’s customer service also reduced its ratings.

Fortunately, each Paychex payroll plan includes 24/7 support by phone and chat.

Customers with the Flex Select plan and up are assigned a dedicated payroll specialist, making it easy and convenient to get answers to payroll-specific questions. Here’s a more in-depth look at Paychex’s customer service options:

| Paychex Customer Service |

Availability |

| Phone Support |

|

| Email Support |

|

| Support Tickets |

|

| Live Chat |

|

| Dedicated Support Representative |

Flex Select plan & up |

| Knowledge Base or Help Center |

|

| Videos & Tutorials |

|

| Company Blog |

|

| Social Media |

|

The inability to contact a payroll specialist is usually a pain point cited by customers using other software solutions, so Paychex gets a big win in the customer service category.

Paychex Integrations

Paychex offers many additional services but still has plenty of third-party integration options. You can connect your Paychex payroll services to 270+ software solutions, including QuickBooks Online, Xero, Sage Intacct, SimplyHired, and many more.

There is also API available for developers.

Paychex Reviews

Paychex’s 3.9/5 user review rating was driven by thousands of user reviews, the majority of which were positive. However, there were a good number of negative reviews that lowered the software’s overall rating. Paychex receives an average of 3.8/5 stars across user review sites.

While it’s important to take negative reviews with a grain of salt (considering the role of negativity bias), there are enough recurring complaints about significant issues, such as unauthorized payments, payroll inaccuracies, and missed tax filings, to take note of them before purchasing the software.

Negative Paychex Reviews & Complaints

- Unauthorized payment withdrawals

- Missed tax filings

- Payroll inaccuracies

- Expensive

Positive Paychex Reviews

- Good customer support

- Easy to use

- Strong payroll features and tax support

- Time-saving

- Convenient mobile app

Is Paychex Secure?

Paychex employs strong security tools to keep your data safe. While the company doesn’t give much more detail about its security measures, it does provide a detailed privacy policy. The company does not share or sell personal information.

- Data encryption

- Malware detection and prevention

- Firewalls

- Multifactor authentication

- Restricted access to confidential information

- SOC reports

Final Verdict Of Paychex

| Paychex Review Summary |

| Pricing Range |

$39/month + $5/employee or custom pricing |

| Choose If You Need |

- Basic payroll features

- An all-in-one payroll and HR solution

- Scalability

|

Paychex offers strong payroll features, including customizable employee management, preprocessing payroll reports, and automatic payroll tax filing. Built-in HR and onboarding set the service apart. The software is well-organized, offers 24/7 customer support, receives many positive customer reviews, and — best of all — Paychex takes care of the entire setup process, so you don’t have to worry. However, it’s difficult to say if the service is worth it for small business owners without knowing exactly how much Paychex costs.

Paychex could be a great choice if you have a small or medium-sized business and you’re looking for payroll and a suite of additional HR and other business services. Contact Paychex directly for a quote and a demo of the software.

If pricing is a concern and you need payroll software that won’t break the bank, check out our picks for the best free payroll software for an in-depth look at the top free payroll software options on the market.

To learn more about how we score our reviews, see our