Pros

- Easy setup

- No long-term contract required

- Integrates with QuickBooks Online

- 24-hour direct deposit

- Comprehensive feature set

- Tax penalty protection

Cons

- Numerous public complaints

- Poor customer support

- Small-print fees

- Capped at 150 employees paid

- Poorly reviewed Workforce app

What is QuickBooks Online Payroll?

QuickBooks Online Payroll is a full-service payroll processing software solution from Intuit that works directly with QuickBooks Online. Small to mid-sized businesses with up to 150 paid employees or contractors can use QuickBooks Online Payroll to automate running payroll, manage HR, handle benefits administration, and manage payroll taxes.

There are two types of QuickBooks payroll products: QuickBooks Desktop Payroll and QuickBooks Online Payroll. While QuickBooks Online Payroll works with QuickBooks Online, QuickBooks Desktop Payroll only works with QuickBooks Desktop Pro, Premier, and Enterprise. Both of QuickBooks’ payroll software options are feature-rich and on the higher end of the price scale.

Small businesses might find all those features dizzying, inflexible, and more expensive than other small business options, such as Gusto or Square Payroll, which keep things simple.

QuickBooks Online Payroll Pricing

QuickBooks Online Payroll rated 2.6/5 stars in the pricing category due to its higher-than-average cost, lack of a discounted annual plan option, and pricey add-ons. However, the software gets points for pricing transparency and plans that are generously packed with features.

QuickBooks Online Payroll offers six payroll pricing plans, with each plan increasing features and benefits as you move up a tier. QuickBooks Online Payroll has month-to-month contracts and no early termination fees. Payments are monthly, and you can cancel your subscription at any time.

Three of the plans only include payroll software, while the other three also include a monthly accounting software subscription.

Here’s a quick look at QuickBooks Online Payroll’s pricing plans:

QuickBooks recently added a separate QuickBooks Contractor Payments pricing tier as a part of its payroll services. This plan serves businesses that only pay contractors and that only need basic payment support for contractors.

QuickBooks also runs promotions for its payroll product frequently, so be sure to check for any available discounts before purchasing. QuickBooks Online Payroll offers a 30-day free trial, but if you opt to try before you buy, you’ll miss out on a 50% off “buy now” promotion.

Compared to other top payroll options with transparent pricing, such as Gusto or OnPay, QuickBooks Online Payroll’s pricing is a bit on the higher end. For example, neither OnPay nor Gusto charges you extra to offer direct deposit for contractors.

Additionally, while QuickBooks Online Payroll’s cheapest plan for paying both employees and contractors doesn’t include local tax filing and payment, both Gusto and OnPay’s cheapest plans do.

QuickBooks Contractor Payments

QuickBooks Contractor Payments standalone payroll plan for paying contractors costs $15+/month and adds a $2 per contractor fee starting with your 21st contractor, and includes:

- Unlimited contractor payments

- Contractor self-onboarding, including W-9 completion and bank details

- Unlimited 1099-NEC and 1099-MISC e-filing for contractors and vendors

QuickBooks Online Payroll Core

QuickBooks Payroll Core includes:

- Full service payroll

- Next day direct deposit

- Unlimited payroll runs

- Calculates paychecks

- Calculates and files federal and state taxes

- Calculates and files year-end forms

- 1099 e-file and pay

- Expert support

- Workforce portal

- Manages garnishments and deductions

- Reporting features

- Healthcare benefits

- 401(k) plans

QuickBooks Online Payroll Core + Simple Start

QuickBooks Online Payroll Core + Simple Start includes all of the payroll features of QuickBooks Payroll Core and includes QuickBooks Online Simple Start accounting software.

QuickBooks Online Payroll Premium

The QuickBooks Online Payroll Premium includes everything in the Core plan, plus:

- Local-level payroll tax support

- Automatic state new-hire reporting

- 24-hour same-day direct deposit

- Expert payroll setup review

- Time tracking on the go

- HR support center

- Workers’ compensation administration

QuickBooks Online Payroll Core + Essentials

QuickBooks Online Payroll Payroll Core + Essentials includes all of the payroll features of QuickBooks Payroll Core, plus QuickBooks Online Essentials accounting software.

QuickBooks Payroll Elite

QuickBooks Payroll Elite includes everything in the Premium plan, plus:

- HR support with a personal HR advisor

- Assisted payroll setup

- Same day direct deposit

- White glove customized setup

- Advanced time and project tracking

- Tax penalty protection of up to $25,000

- 24/7 product support

QuickBooks Online Payroll Elite + Plus

QuickBooks Online Payroll Elite + Plus includes everything from QBO Payroll Elite, plus QBO Plus accounting software.

QuickBooks Online Payroll Extra Costs & Fees

QuickBooks Online Payroll has more than its fair share of extra costs and fees. In addition to common add-on costs for healthcare, users are expected to pay extra for benefits, such as 1099 e-filing, multistate tax filing, and access to QuickBooks Online Simple Start services.

Other providers roll the cost of 1099 e-filing into their plan costs, so having to pay extra for it may cause some businesses to pause. However, as the company partners with providers such as Guideline, SimplyInsured, and AP Intego to provide these services, the prices are on par with its competitors in the payroll software industry.

Is QuickBooks Payroll Easy To Use?

QuickBooks earned a 4.1/5 star rating in the ease of use category with balanced performance in the areas of setup, reliability, daily use, and integrations. The software’s lost points came from its lack of an API, some complaints of glitching, limited white glove setup options, and a poor selection of HR software integrations.

Onboarding is relatively straightforward but will take some time. As cloud-based software, QuickBooks Online Payroll operates with nearly all internet browsers so long as you have internet access.

I found QuickBooks relatively easy to navigate and enjoyed the guided approach to setting up your payroll system. You can play around with the software to get a feel for it before running your first payroll or adding your employees.

There are also desktop versions available, which rate higher among consumers for speed. To read forms and use the print checks feature, you need Adobe Reader 7.0+ or the Firefox PDF plugin. When you set up your check printing in QuickBooks, you’ll find a link to download the most recent version of Adobe Reader.

QuickBooks Online Payroll also has mobile apps for Apple products and Android products.

QuickBooks Online Payroll Features

QuickBooks Online Payroll earned 4.4/5 stars in the features category with plenty of features spanning payroll processing, employee management, time tracking, HR, and benefits administration. The bulk of the software’s lost points come from its local tax support limitations and limited HR integrations.

| QuickBooks Online Payroll Features |

Availability |

| Payroll Tax Support |

|

| Auto-Schedule Payroll |

|

| Bonus Payroll |

|

| Off-Cycle Payroll |

|

| Employee Management |

|

| Paid Time Off |

|

| Time Tracking |

|

| HR Support |

|

| Onboarding Support |

|

| Benefits Administration |

|

| Number Of Reports |

20+ |

| Number Of Integrations |

750+ |

| Number Of Users Supported |

150 |

For the cost and wealth of features, Intuit is well-optimized for mid-sized businesses looking for a full-service payroll solution. As QuickBooks Desktop payroll service does not have a user cap, it’s a better option for companies that plan to grow beyond 150 employees.

Overall, QuickBooks Online Payroll boasts a range of features that make it a great option for businesses already within the QuickBooks ecosystem. As a standalone solution, though, it doesn’t stand out from the competition.

For small and micro businesses looking for self-service payroll, this is an expensive option for the features promised, and you can get more bang for your buck elsewhere.

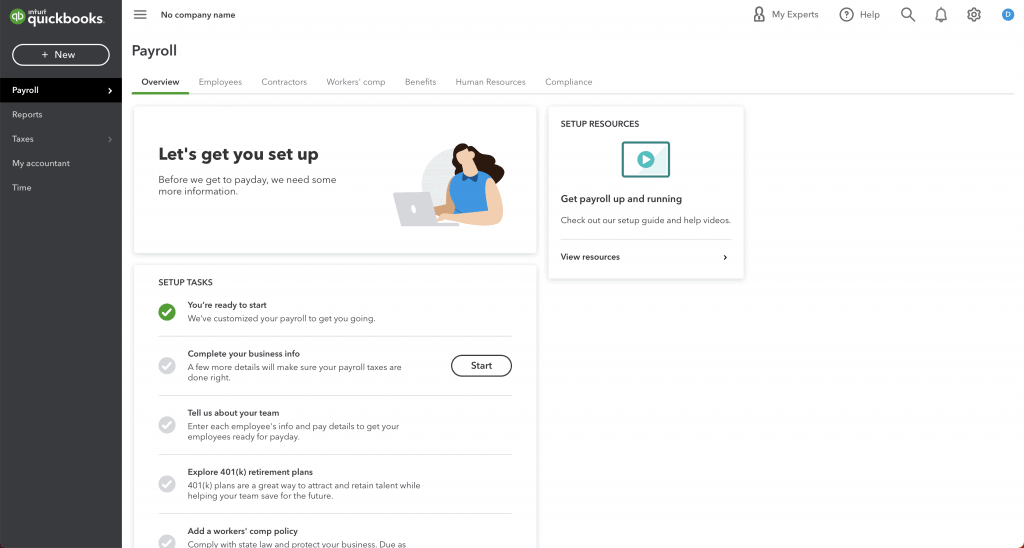

QuickBooks Online Payroll Home Dashboard

Payroll Processing

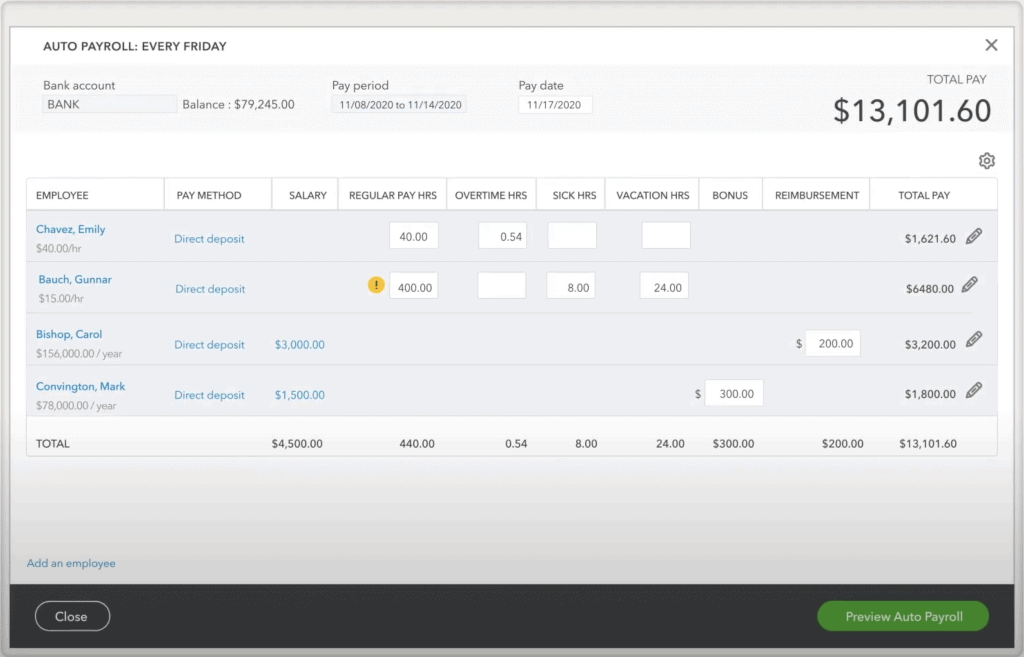

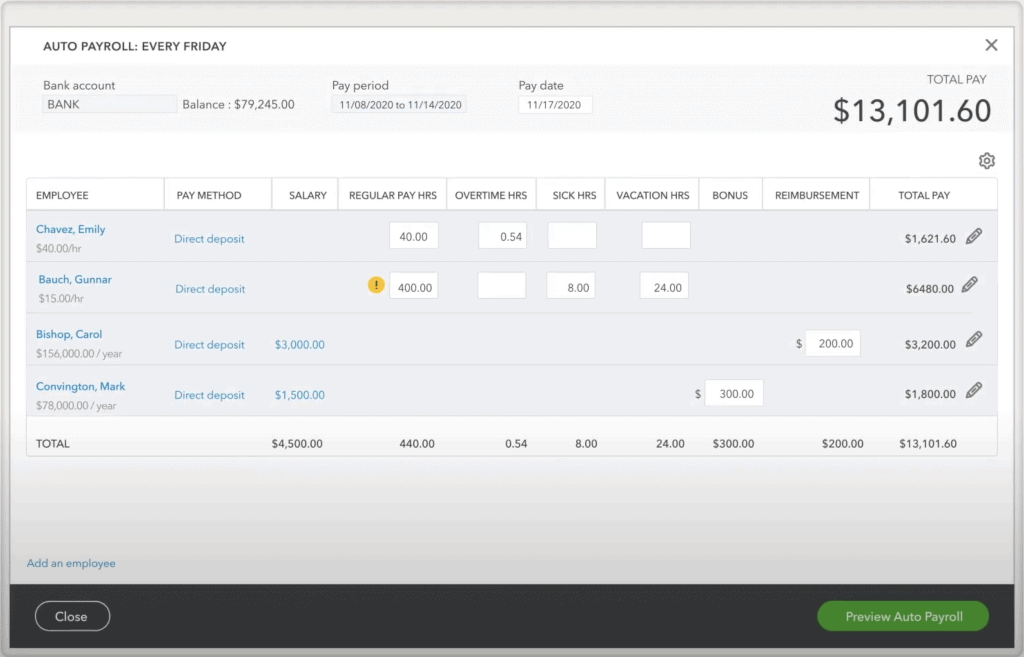

QuickBooks Online Payroll Autorun Payroll

Intuit promises that running payroll is as easy as clicking a button. It takes about two or three minutes to run payroll online. Once your employees are enrolled, their hours and pay scales set, and your pay dates set, running payroll is simple.

Here’s a look at QuickBooks Online Payroll’s payroll processing features:

- Unlimited payroll runs

- 50 state payroll runs

- Multistate payroll

- Auto payroll

- Direct deposit

- Print checks

- Termination paychecks

- Deductions and garnishments

- Multiple pay rates

- Next-day payroll (Premium and up)

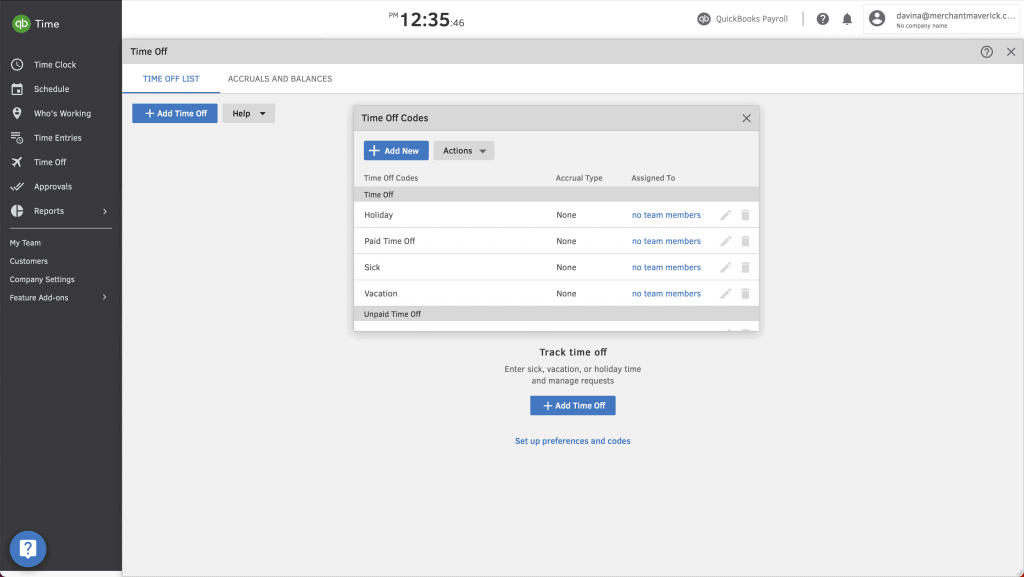

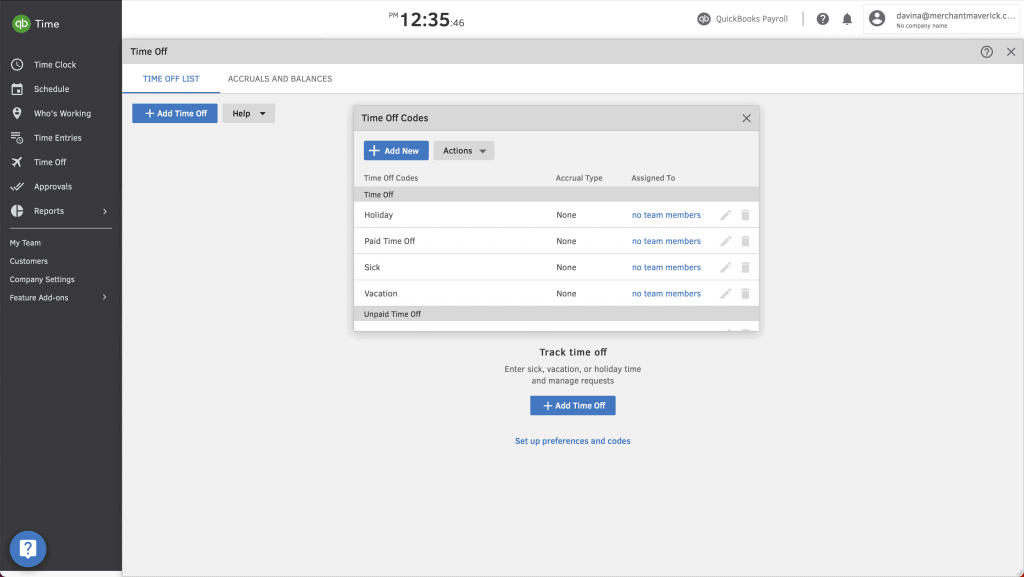

Employee Management & PTO

QuickBooks Online Payroll Time Tracking Dashboard

Intuit has many features to help you manage your employees and contractors from a single interface. You can add various details, including job titles, payment information, time off, tax documents, and benefits. Intuit allows you to manage additional earnings, deductions, and garnishments. Employers also can customize their time-off policies and monitor how much time off an employee or contractor has accrued.

Here’s a look at QuickBooks Online Payroll employee management and PTO features:

- Employee and contractor portal

- Custom PTO policies

- Sick and vacation days

- Paystub printing

- Time off requests

- Tax form access

- PTO accruement

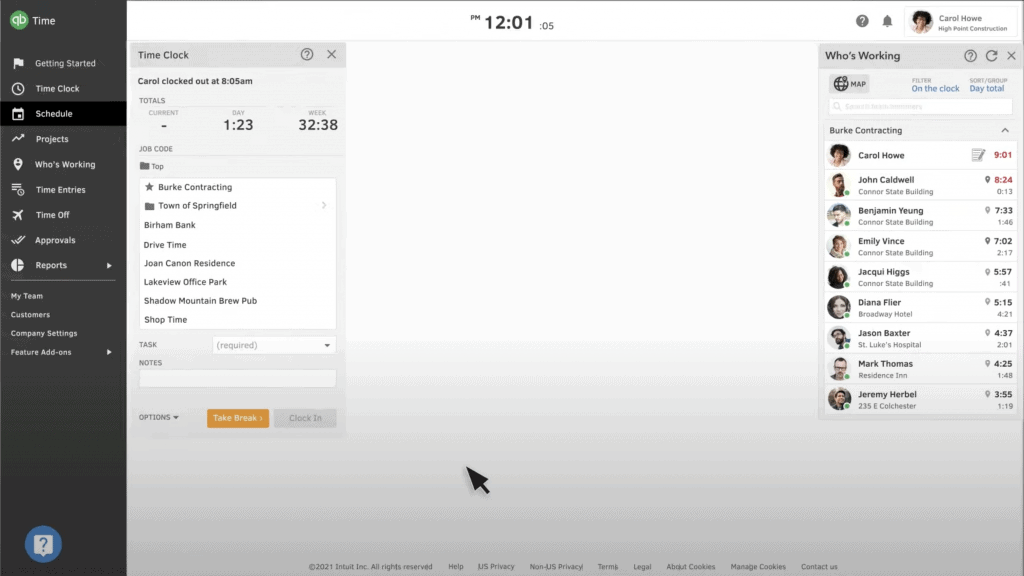

Time Tracking

QuickBooks Online Payroll Schedule Dashboard

QuickBooks’ time tracking offers businesses the ability to manage and track employee and contractor time through a QuickBooks Time integration. Users will need a subscription to the QuickBooks Online Payroll Premium tier to access time-tracking features.

Here’s a look at QuickBooks Online Payroll’s time-tracking features:

- Employee time management

- Mobile time tracking (Premium and up)

- Schedule management

- Time clock reminders

- Time reporting

- Time tracking integrations

Payroll Tax Support

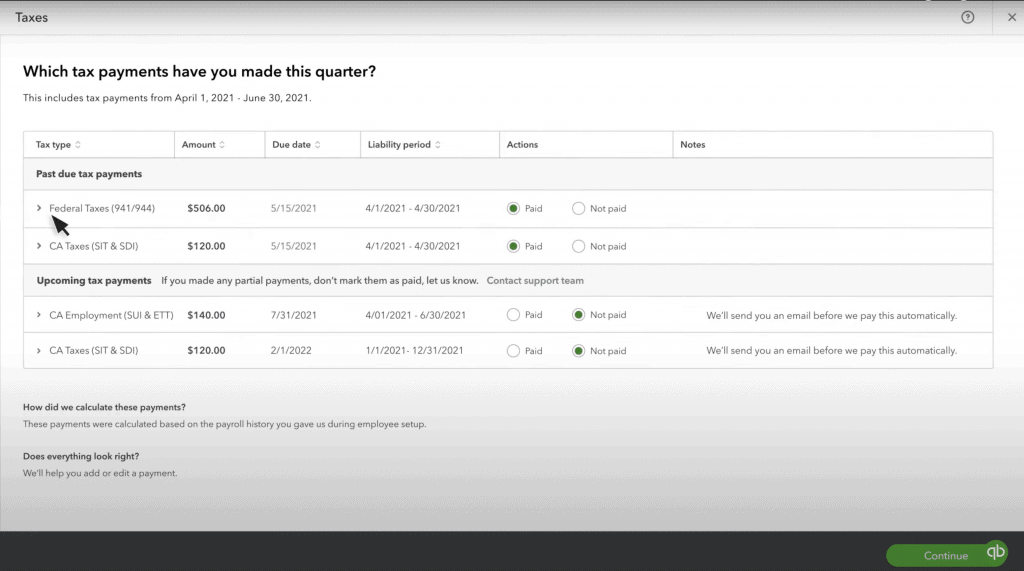

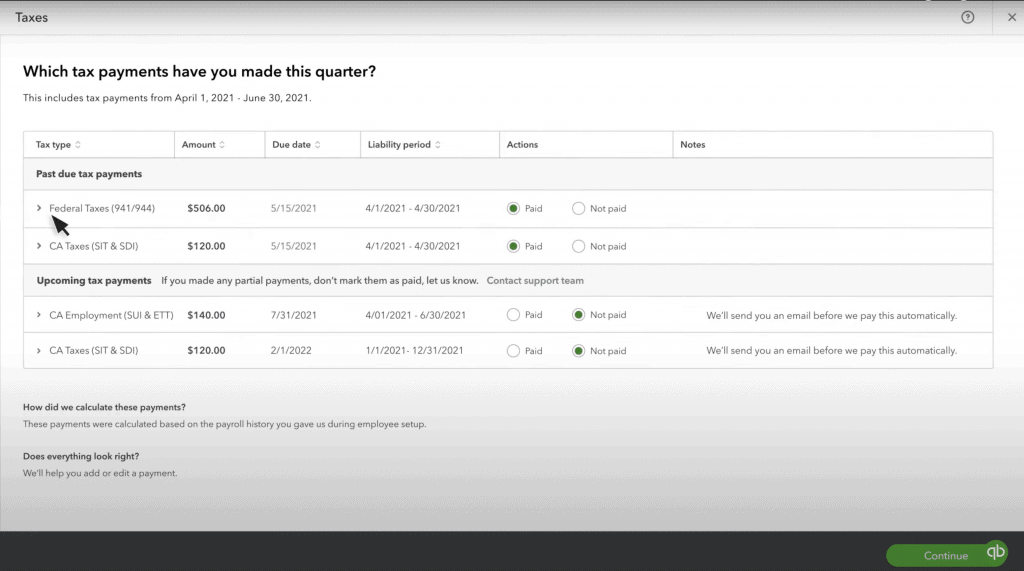

QuickBooks Online Payroll Tax Dashboard

QuickBooks Online Payroll offers basic tax support features on all its plans, including support for 1099 contractors. Intuit will pay your taxes and file your quarterly payroll reports for you. For local taxes, you might be on your own to deduct and allocate; check with a QuickBooks or tax expert.

Here’s a look at QuickBooks Online Payroll’s tax support features:

- TurboTax support

- Auto-calculated payroll taxes (federal and state)

- Auto filed and paid payroll taxes (federal and state)

- 1099 e-file and payment

- Digital and printed W-2 forms

- Digital and printed W-3 forms

Reporting

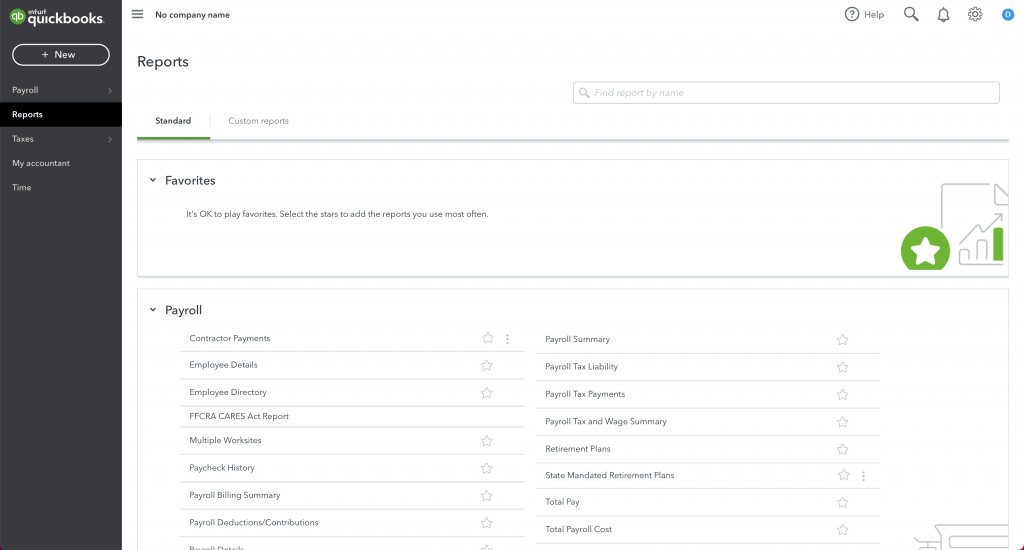

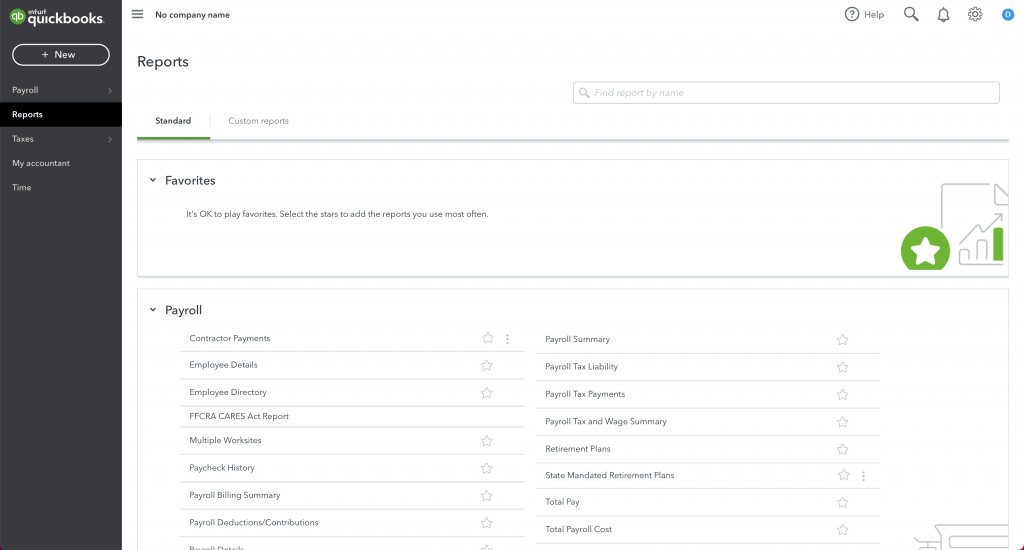

QuickBooks Online Payroll Reports Dashboard

QuickBooks offers plenty of built-in payroll reporting features alongside customizable reports. The platform’s reporting dashboard is easy to navigate and allows users to favorite specific payroll reports for quick access.

Here are some of QuickBooks Online Payroll reporting features:

- 20 built-in payroll reports

- Create custom reports

- Importing and exporting reports

- Search reports by name

HR & Onboarding

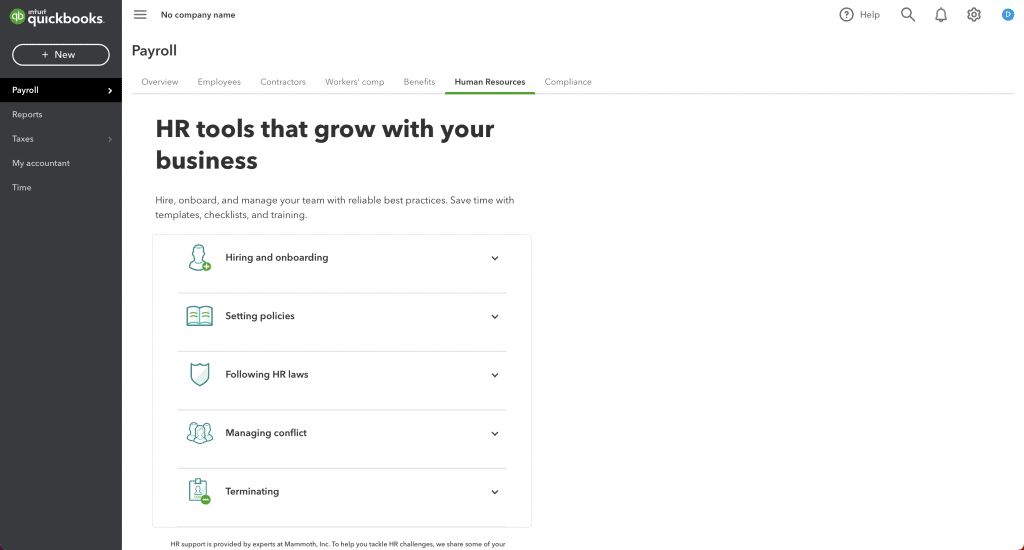

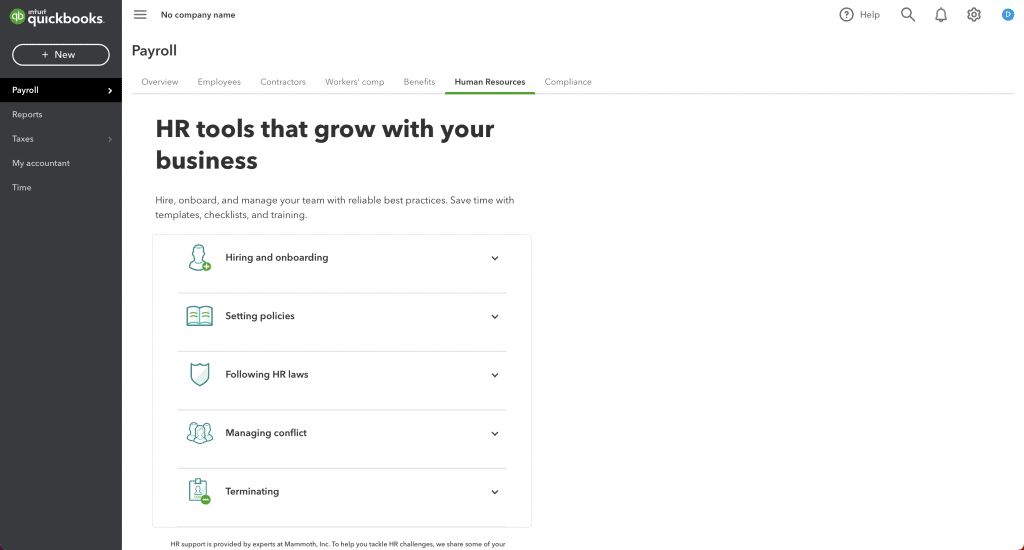

QuickBooks Online Payroll Human Resources Dashboard

QuickBooks Online Payroll only offers HR support on its Premium and Elite plans. Core plan users will get no such support but can upgrade their plan to use the platform’s HR features.

Here are QuickBooks Online Payroll’s HR and onboarding features offered to Premium and Elite users:

- HR resource center

- Offer letter templates

- New hire checklist

- Job description templates

- Employee handbook creation tool

- Create custom HR policies

- Workforce portal

- New-hire reporting

Benefits Administration

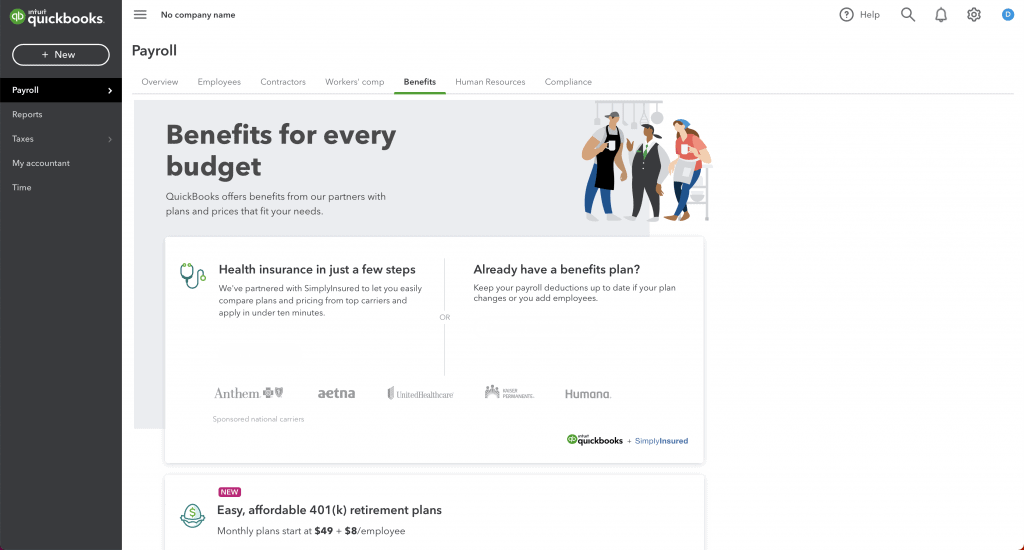

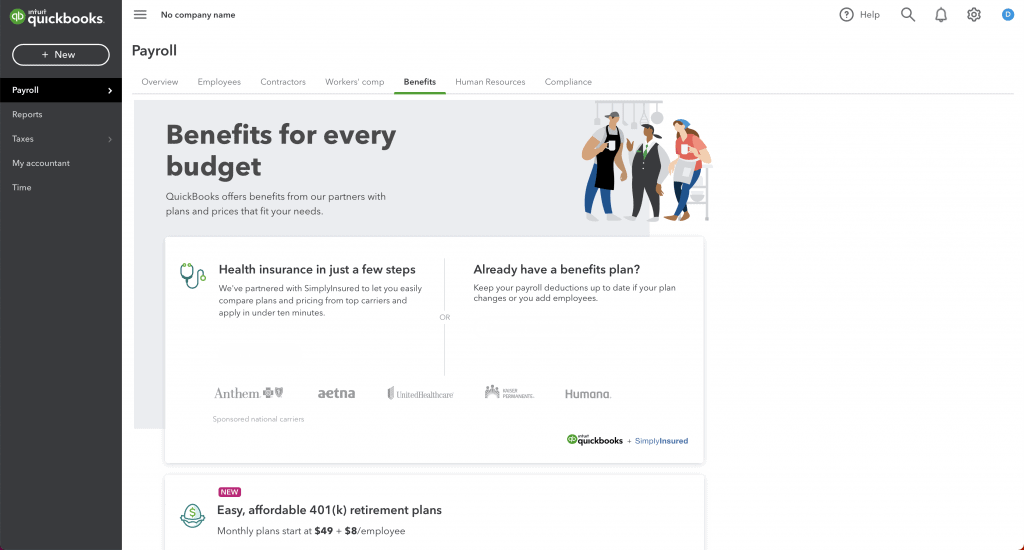

QuickBooks Online Payroll Benefits Management Dashboard

QuickBooks Online Payroll offers health, vision, and dental benefits through SimplyInsured, which doesn’t offer health benefits in Hawaii, Vermont, and DC. Likewise, workers’ comp insurance isn’t available in Ohio, North Dakota, Washington, and Wyoming.

Additional benefits can also be added and managed through the QuickBooks Online Payroll benefits dashboard. There are also options to connect your benefits management, but QuickBooks does not often integrate with things outside the QuickBooks Suite. So, some businesses find themselves going back and forth with record keeping.

Check out QuickBooks Online Payroll’s benefits administration features:

- Benefits management dashboard

- 401(k) retirement plans and matching

- Healthcare benefits

- Vision and dental insurance

- Workers’ comp (Premium and up)

- Credit Karma integration for new hires using Workforce

QuickBooks Online Payroll Customer Service

QuickBooks Online Payroll scores remarkably well in the customer service category with a 4.6/5 star rating that is bolstered by the software’s wealth of support options, extended support hours, and generally favorable user reviews.

QuickBooks’s Online Payroll’s live customer support team works from 6 AM – 6 PM PT Monday through Friday and 6 AM – 3 PM PT on Saturday. Here are some of QuickBooks Online Payroll’s other customer support options:

| QuickBooks Online Payroll Customer Service |

Availability |

| Phone Support |

|

| Email Support |

|

| Support Tickets |

|

| Live Chat |

|

| Dedicated Support Representative |

|

| Knowledge Base or Help Center |

|

| Videos & Tutorials |

|

| Company Blog |

|

| Social Media |

|

Just be prepared to spend some time getting your questions answered if you run into problems.

While the people on the other end of the phone/chat/screen are well-intentioned, very few of them are actual payroll experts. It can take a long time to connect with someone who is.

Intuit QuickBooks is known for outsourcing its help centers, so you may have a hard time connecting with someone who can help.

QuickBooks Online Payroll Integrations

QuickBooks Online Payroll is continuously expanding its integrations. QuickBooks is known for giving access to over 750+ integrations, and the QuickBooks Online program has many you might be familiar with, such as QuickBooks Time, Expensify, Shopify, and Chaser.

A QuickBooks Online Payroll API for time tracking and deductions is available on the platform’s developer sandbox.

QuickBooks Online Payroll Reviews

QuickBooks Online Payroll’s 4.4/5 star rating in the user review category reflects its notably high 4.5/5 star rating across user review sites and its positive feedback on other platforms. However, the software isn’t without its share of complaints.

Positive reviews suggest that the software is easy to use and valuable if you are already within the QuickBooks ecosystem. Complaints include customer service issues, feature limitations, and high pricing.

The Better Business Bureau gives Intuit QuickBooks a good rating overall, but if you delve deeper into the reviews specifically for the payroll program, things turn ugly in a hurry.

There are a plethora of rants about misfiled taxes, miscommunications about payments, and the general ineptitude of the customer service representatives.

Negative QuickBooks Online Payroll Reviews

- Hidden and unauthorized fees

- Tax errors

- Missing payments

- Poor customer service

Positive QuickBooks Online Payroll Reviews

- Onboarding and setup representatives

- Easy-to-use platform

- Excellent QuickBooks integration

- Consistently updated

Is QuickBooks Online Payroll Secure?

Generally, QuickBooks Online doesn’t experience data breaches frequently. Most recently, QuickBooks worked to mitigate its software’s security vulnerabilities to cybercriminals exploiting the logj4 code that QuickBooks software is built on. There is an active security threat at the time of writing. Cybercriminals have exploited logj4 coding present in QuickBooks software to steal data.

QuickBooks Online Payroll has substantial security features to protect its users against fraud and data theft, including monitoring to keep on top of security threats.

Here are some of QuickBooks Online Payroll security features:

- 128-bit SSL encryption

- Multifactor authentication

- Tier-4 data center physical security measures

- Routine security testing

How Does QuickBooks Online Payroll Compare To Other Payroll Software

|

QuickBooks Online |

Gusto |

ADP |

| Price |

$50/month + $6 per employee |

$49/month + $6/person |

Custom pricing |

| Business Size |

Small to medium-sized businesses with up to 150 employees |

Small-medium sized businesses with up to 650+ users |

Small to enterprise-sized businesses with 1,000+ employees |

| Number Of Users |

150 |

Unlimited |

1-1,000+ |

| Number Of States Supported |

50 |

50 |

50 |

| Payroll Processing Time |

Same-day-5 days |

Next day-4 days |

2-5 days |

| Quality Of Features |

Excellent |

Excellent |

Excellent |

| Quality Of Support |

Fair |

Good |

Good |

QuickBooks VS Gusto

Gusto’s customer service, transparent pricing with few added fees, and proven bang for the buck make it a solid QuickBooks Online Payroll competitor.

QuickBooks boasts a fully-featured business software suite, including accounting, invoicing, and business financing, which tends to attract small business owners looking for a comprehensive solution that will support them from funding to finance management.

However, for businesses that are looking for a payroll software solution that offers extensive features without an exorbitant price tag, Gusto is the way to go.

Our Gusto vs. QuickBooks Payroll comparison takes a deeper look into the differences between QuickBooks Online Payroll and Gusto, including pricing, features, and more.

QuickBooks Online Payroll VS ADP

Both QuickBooks and ADP have a long-standing reputation in the B2B space: ADP for its outstanding payroll services and QuickBooks for its accounting software.

So, it’s no surprise that ADP wins out as a more feature-rich and reliable payroll software solution, while QuickBooks offers a solid payroll feature set and stands out for its integration within the QuickBooks Online ecosystem.

QuickBooks boasts transparent pricing, excellent native accounting software integration, and software designed for smaller businesses, while ADP boasts far more extensive payroll and HR features, scalability, and excellent payroll reporting features.

Our QuickBooks versus ADP comparison takes a deep dive into the differences between QuickBooks and ADP, providing a breakdown of each software’s strengths and weaknesses as a payroll software option for small businesses.

The Final Verdict: Is QuickBooks Online Payroll Worth It?

| QuickBooks Online Payroll Review Summary |

| Pricing Range |

$50/month + $6/per person - $229/month + $11/per person |

| Choose If You Need |

- Payroll processing for up to 150 employees

- QuickBooks integration

- HR support

|

QuickBooks is undoubtedly a big player in the business software world, and the recent updates to its full-service platform demonstrate a willingness to adapt and improve. Companies might have to pay for the elite service with some add-ons to get the same price and level of features as other payroll platforms. However, QuickBooks is continuously adapting and reworking its payroll features. Many discounts and sales are available, so the top price is competitive with industry standards.

If you’re a huge fan of QuickBooks Online and its UI, QuickBooks Online Payroll might still win your heart. Brand loyalty goes a long way. Plus, the TurboTax integration for W-2 employees is tempting. However, it is hard to look past the poor customer support, negative reviews, and user cap.

For the average small business owner, if you don’t already use QuickBooks, other options offer more support, flexibility, and value for your money.

Check out our Gusto review or our ADP review for a look at two of the best alternatives to QuickBooks Online Payroll available.

To learn more about how we score our reviews, see our