Pros

- Membership pricing with a 0% per-transaction markup rate

- Next-day funding option available

- Excellent features for both eCommerce & brick-and-mortar businesses

- Month-to-month billing with no long-term contracts or early termination fee

Cons

- US-based merchants only

- Not suitable for very low-volume businesses

- Website lacks full pricing transparency

What Is Stax?

Stax is a merchant services provider whose integrated payments platform includes merchant accounts, eCommerce, mobile processing, inventory management, advanced invoicing and billing, detailed reporting, and much more.

Stax’s pricing model makes it a solid value for merchants processing upwards of $10K/month and is a strong value proposition for many eCommerce merchants, who often get charged a highly inflated rate by payment processors. However, many small businesses will find that Stax’s monthly fees are simply too high.

So, does Stax deserve to be counted among the best credit card processing providers? Read on to find out.

Products & Services

Stax supports just about any business type through a full package of in-house and third-party products. Stax’s membership-based pricing plans come with a full-service merchant account, including 24/7 customer support. Overall, there’s a lot to like here, leading to Stax’s high category score.

Features Overview

Let’s start by breaking down the company’s core services. We’ll then explore the Stax Pay integrated platform.

| Stax Features |

Availability |

| Dedicated Merchant Account |

|

| PCI Compliance |

|

| High-Risk Accounts |

|

| International Accounts |

|

| Contactless Payments |

|

| ACH Processing |

|

| Digital Wallet Acceptance |

|

| EBT Acceptance |

|

| Virtual Terminal |

|

| Mobile POS Reader & App |

|

| Hosted Online Store |

|

| Payment Links |

|

| Payment Gateway Integrations |

|

| Shopping Cart Integrations |

|

| POS Integrations |

|

| BNPL Integrations |

|

| API Documentation |

|

| Currency Conversion |

|

| Recurring Billing |

|

| Invoicing |

|

| Cash Discount Program |

|

| Cryptocurrency Processing |

|

Payment Processing Services

- Merchant Accounts: Unlike payment services providers (PSPs) such as Square, Stax offers full-service merchant accounts with a unique merchant ID number for each business. However, the company is not a direct processor and partners with Worldpay for actual payment processing.

- Countertop Terminals: For brick-and-mortar merchants, Stax offers a choice of several terminals, including Dejavoo smart terminals and the full line of Clover POS hardware. If you already have a terminal, Stax will also reprogram it to work with its system for free. You can add a protection plan to get more comprehensive support for your terminals. This is the ideal option if you don’t care about integrating your terminal with your POS system. Thankfully, Stax sells terminals outright instead of leasing its credit card machines.

- Integrations: Stax doesn’t have an extensive list of third-party integrations proudly displayed on its site the way some payment processors do. But you can integrate Stax’s payment processing into other solutions, including various payment gateways, shopping cart solutions, POS systems, and other software, including QuickBooks.

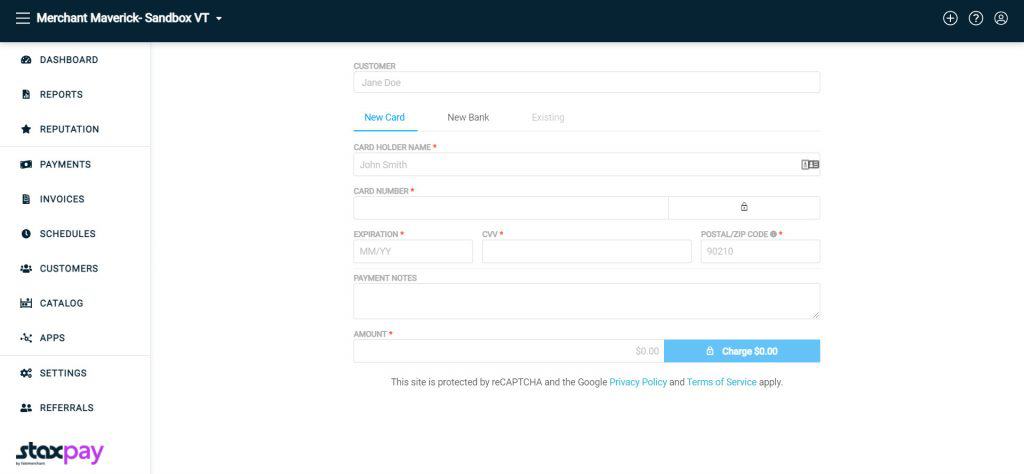

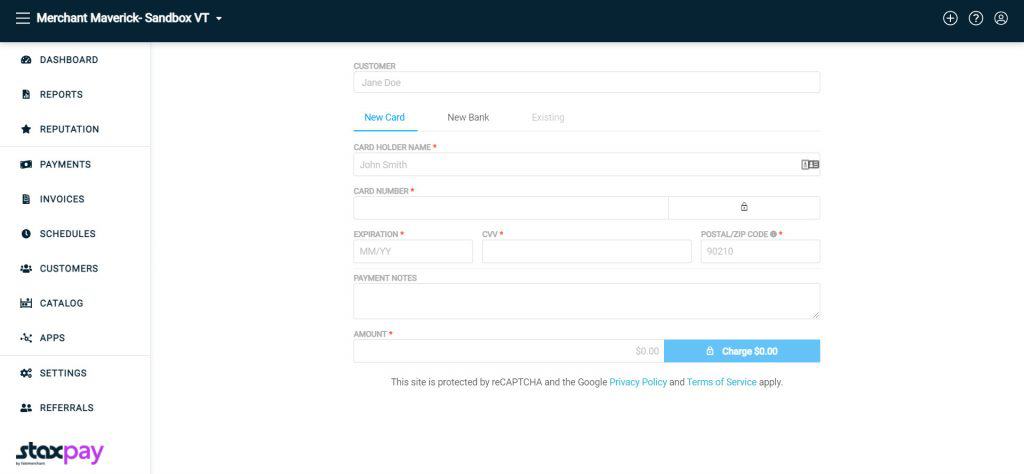

- Virtual Terminal: Stax’s virtual terminal can be a great deal if you mainly key in your payments through a computer (such as in an office environment or by taking phone orders). You’ll also get access to a customer database, invoicing, and inventory management features, which we’ll talk about shortly. Plus, the virtual terminal can connect to Stax’s credit card readers, so you can take advantage of in-person rates. If you don’t want a full shopping cart but need an easy way to accept payments online, Stax Pay includes a very basic website payments feature that starts at the growth plan level.

- Mobile Processing: The Stax Pay mobile app is available for both iOS and Android. The Swipe Simple B250 mobile card reader is offered as an mPOS option — it connects via Bluetooth and supports EMV payments as well as mobile wallet payments (Apple Pay, Google Pay, Samsung Pay, etc). The Stax website indicates that the Dejavoo QD2 wireless smart terminal is also available. The mobile plan includes access to other aspects of the Stax platform at no additional cost, specifically invoicing and inventory.

- Shopping Cart: Stax offers a customizable shopping cart for eCommerce businesses. You’ll keep customers on your site during the entire process, and you have control over the look and feel of your shopping cart. This is more advanced than the website payments feature included with the Stax virtual terminal.

- Developer Tools: For developers or businesses that would like to use Stax for processing but have their own custom credit card processing software needs, the Stax API allows for easy integration. Stax just provides the documentation, so BYOD (bring your own developer)! It’s no Stripe (the platform’s not even as open as Square), but you can do quite a lot with it. There’s a JavaScript library for web payments, but if you prefer to skip handling your customers’ card data altogether, the invoice function will direct customers to a Stax-hosted site. Plus, there’s a mobile SDK for iOS and Android.

Stax Pay Software Suite

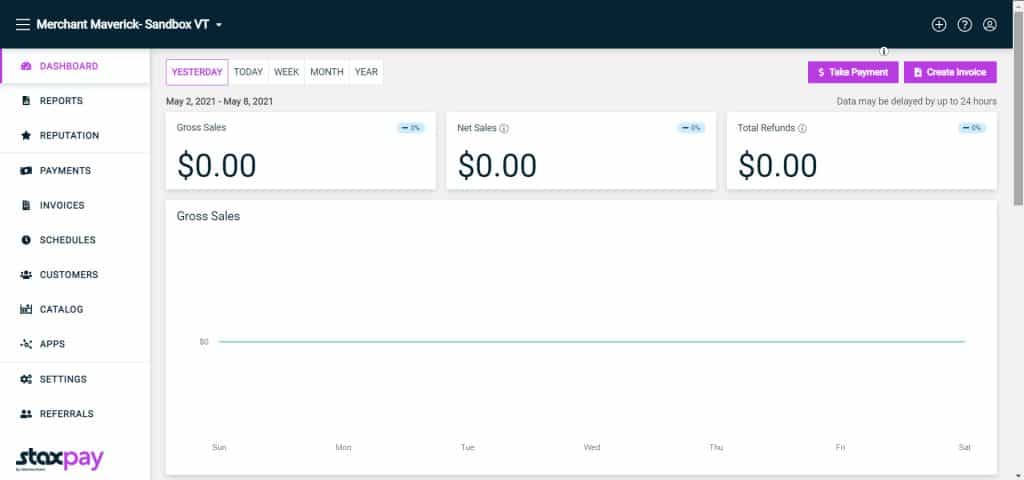

Stax accounts include the Stax Pay integrated payments platform. The platform centralizes all of your transactional information and provides several other features as well. Let’s take a look at Stax’s customer database, invoicing, inventory, and reporting features:

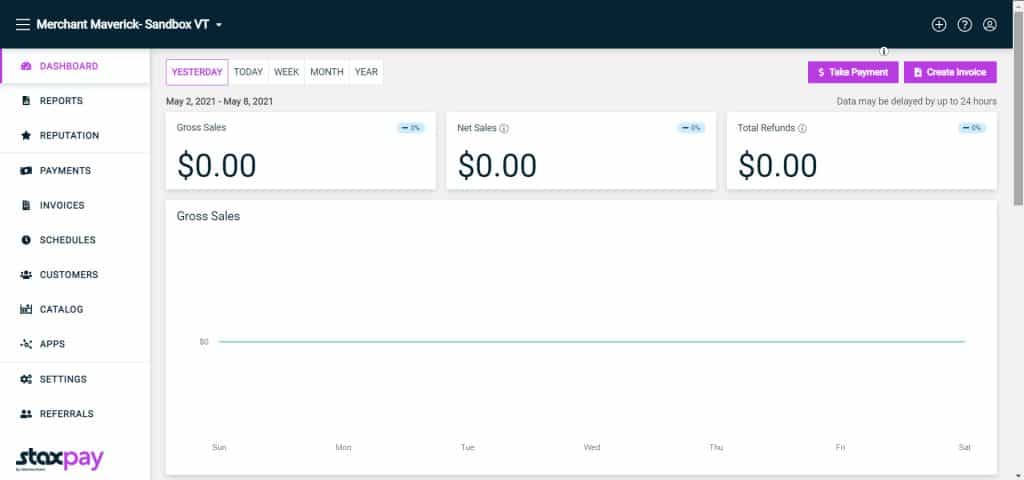

- Centralized Web Portal: Logging into the Stax Pay platform will give you all of the information about any of the Stax services you’re using. Overall, the Stax Pay portal is fairly easy to use and surprisingly intuitive, but Stax also offers a relatively basic but explanatory tutorial. I think the tutorials could be fleshed out with more detail for those who are hesitant to go poking around the dashboard. However, it seems that most of Stax’s customers have no trouble finding their way around.

- Customer Database: The customer database lets you keep track of important details, such as preferred payment methods, purchase histories, invoices billed to the customer, along with any other useful data. You can also store cards on file so that you don’t need to ask for your customers’ card information every time they make a purchase.

- Inventory Management: Stax’s inventory system is surprisingly functional, though it’ll never rival a full-scale POS. Still, it can be a handy tool if you’re using invoicing or website payments, the virtual terminal, or the mobile app. While you won’t see barcode or SKU support, the inventory tracking and centralized catalog are still nice. Inventory features include:

- Mark item as a service

- Low-stock alerts

- Set discounts

- Manage tax rates

- Item categories

- Attach image files

- Invoicing: You can send invoices from the mobile app or the virtual terminal. Unsurprisingly, the invoicing feature syncs with your customer database and item catalog to fill in key details. You can even set recurring invoices and see your scheduled invoices at a glance. It’s not as advanced as PayPal or Square, but Stax will get the job done. However, if you want the ability to require down payments, set up installments, or anything more advanced, you might be better served by a dedicated recurring billing service.

- Reporting: Previously, the reporting features were rather basic at the bottom-tier subscription level and grew more sophisticated as you moved up the subscription ladder. However, the full reporting package now appears to be available from the start. In addition to your financial data, you’ll get item sales and item category reports, a projected inventory report, and the ability to view all your data from multiple sales channels.

Stax’s approach to an integrated, all-in-one platform for payment processing isn’t without its flaws. As far as execution goes, however, Stax has done well. The centralized platform works, even if it’s not as strong as what you would get with standalone software in each category. I don’t think Stax is even as robust as Square.

However, there’s one significant difference between Stax and Square: Stax sets its customers up with unique merchant accounts, translating into greater account stability. For larger businesses that don’t necessarily need all the bells and whistles, Stax is a strong solution.

Stax also offers additional payment solutions, including Stax Bill for subscription billing, Stax Connect for SaaS businesses, and CardX by Stax for businesses that want to implement credit card surcharging.

Fees & Rates

Stax offers its core services in all-in-one packages, which are quite reasonable for mid-and high-volume businesses, and especially those that need all the many services Stax offers. However, the high monthly fees and lack of full pricing transparency from Stax means that their score must take a hit in this category.

Pricing Overview

| Item | Value | | Pricing Range | $99-$199+/month |

| Contract Length | Month-to-month |

| Processing Model | Membership |

| Card-present Transaction Fee | $0.08 + interchange fee per transaction |

| eCommerce Transaction Fee | $0.15 + interchange fee per transaction |

| Keyed-in Transaction Fee | $0.15 + interchange fee per transaction |

| Equipment Cost | Not disclosed |

Monthly Plans

Your Stax monthly fee depends on your processing volume. Here are the monthly plan tiers that Stax has published on its website:

| Stax Plans |

Price |

When To Use |

| Process up to $150K/year (up to $12,500/month) |

$99/month |

For low-volume sellers |

| Process $150K-$250K/year (up to $20,833/month) |

$139/month |

For mid-volume sellers |

| Process $250K-$500K/year (up to $41,667/month) |

$199/month |

For medium/high-volume sellers |

| Process over $500K/year (more than $41,667/month) |

Custom quote |

For high-volume sellers |

Though this isn’t disclosed on the website, Stax’s monthly subscription fee generally goes up about $100/month for each additional $500K/year that the merchant is processing. So for example, merchants in the $500k – $1M annual range will typically be quoted a monthly subscription of $299/month. We have heard reports of some very high-volume merchants paying as much as $699/month.

Monthly subscription fees typically cover just about everything beyond the payment processing, so you shouldn’t be paying:

However, some Stax complaints posted by merchants indicate that some merchants are being changed some of these fees on top of their monthly subscriptions. If you sign up with Stax, confirm with the company exactly which ancillary fees you’ll be expected to pay.

Services like ACH processing, its one-click shopping cart, and next-day funding on an a-la-carte basis, although the company offers no pricing information regarding these add-ons, and we never like to see a provider going in the wrong direction when it comes to transparency. In particular, we wish that monthly pricing for Level 2 processing, which can lower your interchange rates for card-not-present transactions, were listed.

Transaction Fees

Of course, there are per-transaction fees as well. Unfortunately, Stax no longer publishes its per-transaction rates on its Pricing page and instead simply states that you’ll pay “0% Markup on direct-cost interchange” (of course, there is a markup; it just comes in the form of the monthly fee). However, do a Google search or two, and you’ll find pieces in Stax’s blog that still advertise the following rates:

- Swiped/Dipped/Tapped Transactions: $0.08 + interchange fee per transaction

- Keyed-In Transactions: $0.15 + interchange fee per transaction

These transaction fees are quite good, though when taking into account the monthly fee, Stax isn’t all that cost-effective for very low-volume businesses that want an all-in-one payment platform. Without the large volume to deliver cost savings, the monthly fees add quite a bit to that overall markup. If you’re processing less than $10,000 per month (or thereabouts), you’ll be better served by finding another platform that offers more affordable pricing for multiple payment channels.

Extra Costs

According to Stax representatives, these are some miscellaneous fees that may be incurred (note that none of these are regular/monthly fees):

Sales & Advertising Transparency

Stax’s website is professional and easy to navigate. There’s a decent amount of useful information for prospective merchants and clear listings of the monthly fees you’ll pay. However, we wish the company would divulge pricing information regarding its optional add-ons, and we don’t like that Stax no longer publishes its per-transaction rates on its Pricing page, nor do they list their higher monthly fees for businesses processing more than $40K/month. That’s why Stax doesn’t get excellent scores in this category.

Stax also has an active social media presence on Facebook, X/Twitter, LinkedIn, Instagram, and YouTube. Finally, Stax offers some customer testimonials on its Customer Reviews page.

Stax relies on an in-house sales team and an online signup process to bring on new merchants. The online setup process is a good choice if you’re in a hurry to get your account activated ASAP. We recommend talking to a sales representative rather than signing up online if you doubt how well Stax will work for your business. We like that Stax has an in-house sales team because using third parties tends to present all sorts of troubles.

Contract Length & Early Termination Fee

Regarding contract transparency, Stax publishes its Terms and Conditions right on its website — something few providers will do for you.

All Stax accounts feature month-to-month billing with no early termination fee. You’ll need to provide thirty days’ notice when you close your account, but that’s it. This is exactly what we like to see, and it’s what you should be looking for in a payment processor. We encourage you to read your entire merchant agreement very thoroughly before signing up.

Customer Service & Technical Support

Stax’s extensive knowledgebase reduces the likelihood that you’ll need direct support from the company. We appreciate that there’s a functioning search bar.

| Stax Customer Service |

Availability |

| Phone Support |

|

| Email Support |

|

| Support Tickets |

|

| Live Chat |

|

| Dedicated Support Representative |

|

| Knowledge Base or Help Center |

|

| Videos & Tutorials |

|

| Company Blog |

|

| Social Media |

|

If you need to reach out to a customer support representative, Stax offers free 24/7 technical support via an email ticketing system. You can also call Stax for direct support.

It’s common for merchant services providers to receive a lot of negative feedback about customer support from frustrated merchants. In past reviews, we found that Stax reviews posted by users were unusually positive about the quality of the customer service. We’re now seeing more complaints about Stax’s customer service than we had previously, but overall, the picture doesn’t look terrible here.

User Reviews

User reviews of Stax are mostly positive, but complaints have been getting more frequent lately. The company currently gets an average rating of 3.3/5 on Capterra, 4.1 out of 5 at Trustpilot. Over at the BBB, the company is accredited with an A+ rating but with an average customer rating of 1/5 (26 reviews). Of course, visitors to a company’s BBB page are likely to be there with complaints in mind.

Stax has seen 78 BBB complaints against it closed in the past three years and 21 complaints closed in the past year. For a processor of Stax’s size, this is not great, but not terrible. Stax does respond to each disgruntled merchant individually, which is a good thing to see.

Negative Reviews & Complaints

Here are the issues most commonly mentioned (and these issues are being raised more frequently as of late):

- Billing issues

- Customer service problems

- Withheld funds

- Hidden monthly fees

Positive Reviews & Testimonials

Numerous Stax reviews found online are positive, with many merchants praising the customer service. You can find many user reviews in which individual Stax representatives are singled out for praise. We have also seen reports of customers being given the runaround, however.

Other points of praise include the following:

- Easy-to-use software

- Straightforward pricing

- Good invoicing capabilities

If you want to see more praise, you can check out Stax’s “Customer Reviews” page on its website. The testimonials — mostly from local businesses in the Orlando area — come across as unscripted and genuine.

Final Verdict

Stax’s membership pricing model has the benefit of being easy for merchants to understand, and we like that the company now offers the same standard feature set to all new users, regardless of subscription level. However, we can’t help but notice that the company is not 100% transparent about its pricing.

Additionally, the company’s user reviews have gotten less rosy over the last few years, with reports of poor customer service and undisclosed fees.

In terms of costs, Stax is not a great value for low-volume merchants, especially ones with small ticket values. Merchants processing less than $10,000 per month or so will save money overall by using a payment service provider (PSP) such as Square. However, merchants consistently processing above that amount—especially those that make use of Stax’s excellent feature set—will likely find that Stax’s pricing suits them.

All in all, the total value provided by Stax’s platform — including eCommerce tools, centralized invoicing, data analytics, inventory management, and other features — makes the service compelling to midsize and larger businesses, especially considering the stability a full-service merchant account offers.

Nonetheless, it’s important to price out whether your particular business can actually save money with Stax, or if an interchange-plus provider or PSP would suit your business better. To this end, make sure you get a full breakdown of fees before committing to Stax.

To learn more about how we score our reviews, see our